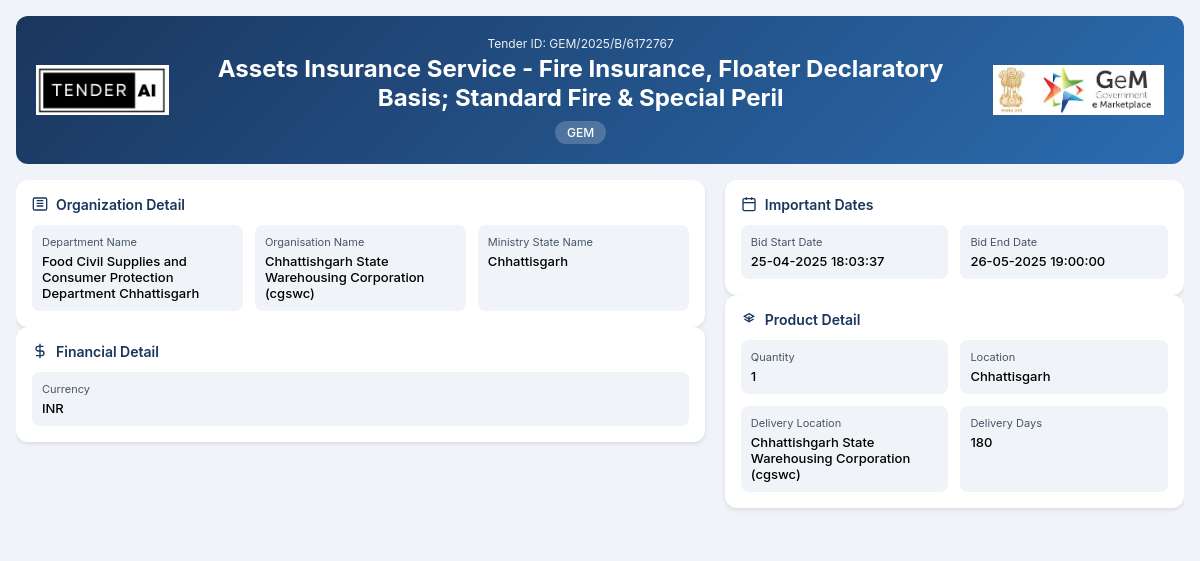

Food Civil Supplies and Consumer Protection Department Chhattisgarh Tender by Chhattishgarh State Warehousing Corporation (cgswc) (GEM/2025/B/6172767)

Assets Insurance Service - Fire Insurance, Floater Declaratory Basis; Standard Fire & Special Peril

Tender Timeline

Tender Title: Assets Insurance Service - Fire Insurance, Floater Declaratory Basis

Reference Number: GEM/2025/B/6172767

Issuing Authority:

Food Civil Supplies and Consumer Protection Department Chhattisgarh

Scope of Work and Objectives:

The Assets Insurance Service tender aims to provide comprehensive insurance solutions covering fire insurance and special perils on a float declaratory basis. The insurance coverage will include Standard Fire & Special Peril Covers, as well as coverage for Storm, Typhoon, Hurricane, Tornado, and Flood and Inundation (STFI). Additionally, the tender includes Terrorism and RSMD (Risks of Storage Miscellaneous Damage) coverage as optional components. The overarching objective is to safeguard state assets against various risks, ensuring financial protection and operational continuity in adverse scenarios.

Eligibility Criteria:

To participate, bidders must be a registered entity qualified for insurance services. Key eligibility criteria include:

- Possession of necessary insurance licenses

- Previous experience in handling similar insurance services

- Valid registration with relevant authorities

- Adherence to regulatory compliance standards applicable to the insurance sector

Technical Requirements:

Bidders must fulfill specific technical requirements that include:

- Incorporation of advanced risk assessment methodologies

- Provision of a customer support framework adhering to best practices

- Documentation of claims handling procedures

- Implementation of requisite IT infrastructure to manage insurance processes efficiently

Financial Requirements:

Bidders should demonstrate sound financial stability, validated by financial statements from the past three years. Applicants are required to provide evidence of capability to manage large-scale insurance operations and to cover claims without delays.

Document Submission Details:

Bid submissions must be made electronically through the designated portal. Required documents include, but are not limited to:

- Bidder's technical proposal

- Financial proposal

- Evidence of eligibility criteria fulfillment

- Certifications and licenses

Special Provisions:

This tender provides benefits for Micro, Small, and Medium Enterprises (MSEs) and provisions that can support startups. This inclusion aims to foster market competition and encourage new entrants in the insurance sector.

Evaluation Process:

Bids will be evaluated based on technical competence and financial viability. The evaluation process includes:

- Initial scrutiny of bid completeness

- Detailed analysis of technical proposals

- Financial assessment to determine cost-effectiveness

- Shortlisting based on ratings from evaluated criteria

Delivery Locations:

The services provided under this tender will be applicable across various government asset locations within Chhattisgarh.

Contact Information:

While specific contact information is not available, bidders are encouraged to regularly check the tender portal for updates and further inquiries regarding the submission process and tender specifications.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

5 DocumentsDocuments Required from Seller

- Certificate (Requested in ATC)

- Additional Doc 1 (Requested in ATC)

- Additional Doc 2 (Requested in ATC)

- Additional Doc 3 (Requested in ATC)

- Additional Doc 4 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements for bidders seeking to participate include being a registered entity that specializes in insurance services, with the necessary insurance licenses. Bidders are also required to demonstrate experience in handling similar projects and ensure compliance with the applicable regulatory standards.

Bidders must meet specific technical specifications such as implementing advanced risk assessment methodologies and providing a structured claims handling process. It is essential to have a reliable customer support framework that adheres to best industry practices, ensuring that all operational aspects are covered effectively.

An Earnest Money Deposit (EMD) may be required to show the bidder’s commitment and financial capability. The exact amount and payment terms will be specified in the tender documents. Bidders must prepare to include the EMD details when submitting their proposals.

The selection process entails a comprehensive evaluation that includes an initial scrutiny of the completeness of submissions, followed by a detailed assessment of technical proposals. Financial aspects are also critically analyzed to ensure that selected bids offer the best value and meet the predefined technical compliance criteria.

Yes, there are specific provisions for MSEs incorporated in this tender. These provisions aim to support small enterprises in gaining access to government contracts, thereby promoting competition and enabling diverse participants in the insurance sector. Additionally, measures for startups are also taken into account, fostering innovation and new business growth.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders