Tender Timeline

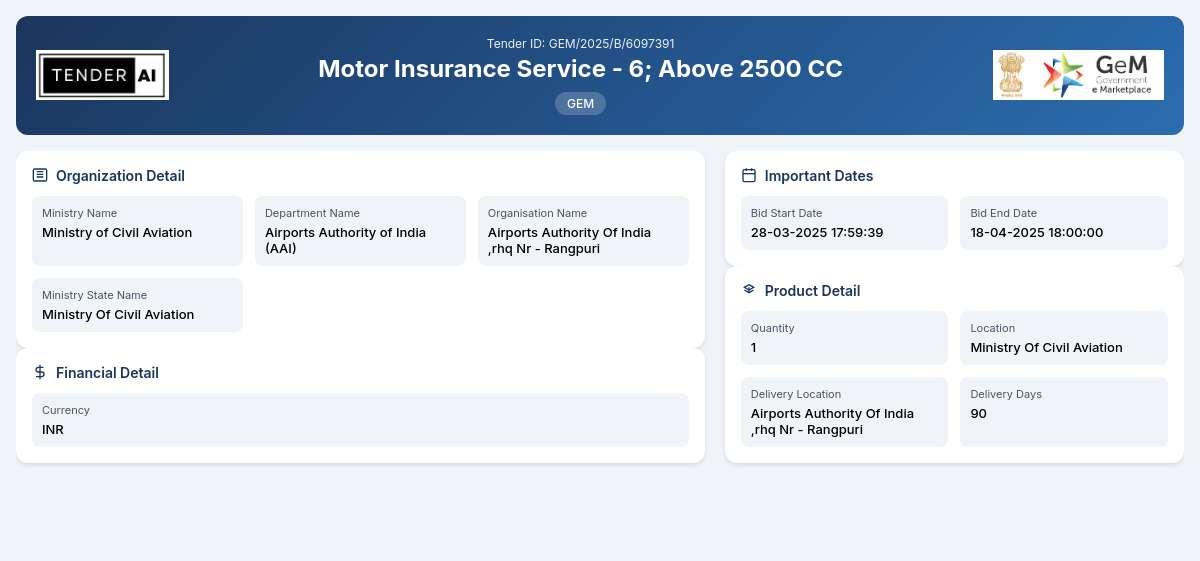

Tender Title: Motor Insurance Service - 6; Above 2500 CC

Reference Number: GEM/2025/B/6097391

Issuing Authority

The tender is issued by the Airports Authority of India (AAI), under the Ministry of Civil Aviation.

Scope of Work and Objectives

The objective of this tender is to procure Motor Insurance Services for vehicles with a capacity exceeding 2500 CC. The selected service provider will be responsible for delivering comprehensive insurance services that ensure the protection of the authority's assets and personnel against various risks associated with motor vehicles. The scope includes but is not limited to assessing risks, underwriting, policy issuance, claims processing, and providing necessary assistance during the claim settlement process.

Eligibility Criteria

To participate in this tender, bidders must satisfy the eligibility criteria set forth by the issuing authority. Key requirements include:

- Registration as a valid insurance provider with relevant certifications.

- Demonstratable experience in providing motor insurance services.

- Compliance with regulatory requirements governing insurance operations in India.

Technical Requirements

The technical specifications for this tender include:

- Provision of comprehensive motor insurance covering all essential risks associated with vehicles exceeding 2500 CC.

- Facilities for 24/7 customer support and claims assistance.

- Digital platforms for policy management and claim submission.

- Adherence to the Insurance Regulatory and Development Authority of India (IRDAI) guidelines.

Financial Requirements

Bidders must provide financial documentation to show their capability to underwrite and service the required insurance. This includes a clear pricing structure, evidence of financial stability, and any relevant Earnest Money Deposit (EMD) details requisite for participation.

Document Submission Details

All required documents must be submitted electronically through the designated online portal or as specified by the Airports Authority of India. Bidders should ensure that all submissions are complete and adhere to the specified format outlined in the tender documentation.

Special Provisions

The tender acknowledges Micro, Small, and Medium Enterprises (MSE) and startups. Specific benefits may include relaxed eligibility criteria and financial assistance for participation, supporting the government’s initiative to foster these sectors.

Evaluation Process

The evaluation of bids will be conducted based on predefined criteria focusing on compliance with technical and financial requirements. The bidder with the highest rated proposal will be awarded the contract. Factors such as price competitiveness, service quality, and compliance with the eligibility requirements will be considered.

Delivery Locations

Insurance coverage will be applicable to all motor vehicles under the operation of Airports Authority of India, across various locations dictated by operational needs.

Contact Information

For further queries regarding this tender, bidders are encouraged to reach out via the contact details provided on the official website. Ensure all communications are clear and concise to facilitate effective assistance.

The completion of this tender process aims to enhance operational efficiency while ensuring robust insurance coverage for the Airports Authority of India. Participants are encouraged to meticulously review the requirements and prepare their proposals to meet the set standards effectively.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

5 DocumentsDocuments Required from Seller

- Experience Criteria

- Additional Doc 1 (Requested in ATC)

- Additional Doc 2 (Requested in ATC)

- Additional Doc 3 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Corrigendum Updates

Similar Tenders

Frequently Asked Questions

The eligibility requirements for participating in insurance tenders typically include being a registered insurance provider in India and having the necessary qualifications in line with the regulations set by the Insurance Regulatory and Development Authority of India. Bidders must provide documentation proving their experience and expertise in motor insurance services.

Bidders must adhere to specific technical specifications, which include comprehensive coverage for vehicles over 2500 CC, provision for 24/7 claims assistance, and compliance with current insurance regulatory standards. Service offerings should also support digital platforms for policy management and claims submission.

The Earnest Money Deposit (EMD) varies based on the specific tender and is intended to ensure the commitment of bidders. It typically ranges from a nominal amount and must be submitted alongside the proposal. Detailed information regarding the exact amount can be found in the tender document.

Bidders can submit their documents electronically through the specified online portal. It’s crucial to follow the indicated submission methods and ensure all submissions are compiled according to the formats outlined in the tender guidelines. Missing or incorrectly formatted documents may lead to disqualification.

MSEs participating in this tender may be granted special provisions, including relaxed eligibility criteria and potential financial support for their proposals. This initiative is aimed at fostering inclusivity within the bidding process and encouraging small businesses to participate in government tenders, aligning with policies like ‘Make in India’.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders