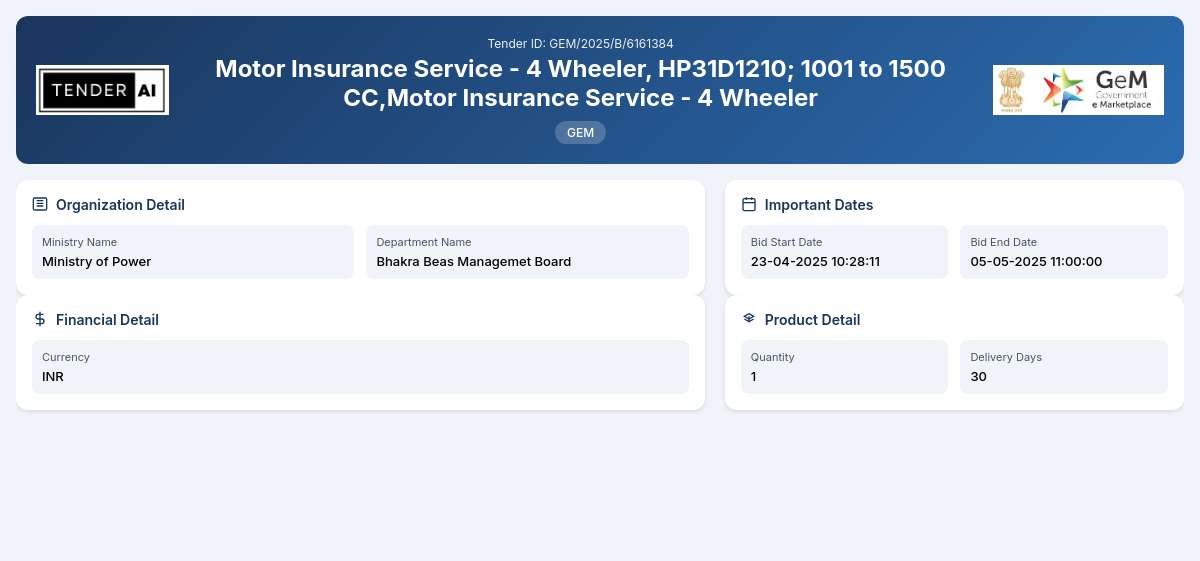

Bhakra Beas Managemet Board Tender by Bhakra Beas Management Board (GEM/2025/B/6161384)

Motor Insurance Service - 4 Wheeler, HP31D1210; 1001 to 1500 CC,Motor Insurance Service - 4 Wheeler

Tender Timeline

Tender Title: Motor Insurance Service - 4 Wheeler

Reference Number: GEM/2025/B/6161384

The Motor Insurance Service tender issued by the Bhakra Beas Management Board, under the Ministry of Power, invites interested and qualified vendors to provide comprehensive motor insurance services for four-wheel vehicles. This tender encompasses the insurance coverage of the vehicles ranging from 1001 to 1500 CC. This initiative aims to enhance the operational continuity and safety of the vehicles under the management of the Ministry.

Scope of Work and Objectives

The primary objective of this tender is to capture comprehensive insurance coverage that protects against liabilities arising from accidents, damage, theft, and other unforeseen events. Vendors will be expected to deliver efficient service and support, ensuring that the vehicles are well-protected while complying with the stipulations of existing laws and regulations. The successful bidder will provide a range of services including but not limited to:

- Policy issuance

- Claims management

- Support services.

Eligibility Criteria

To qualify for this tender, bidders must be legally registered entities and possess the requisite licenses to offer motor insurance services. It is essential for vendors to demonstrate experience in handling similar contracts, ensuring compliance with local and national insurance regulations, and commitment to quality insurance.

Technical Requirements

Bidders must showcase their capability in providing motor insurance services, including certifications, and technical documentation that affirm their compliance with the industry standards. Technical specifications must align with those required by the Ministry, and include:

- Comprehensive coverage details

- Risk management procedures

- Claim handling processes.

Financial Requirements

Bidders are required to submit detailed financial proposals, demonstrating their capability to provide competitive premiums while ensuring the complete safety of the insured vehicles. Financial stability and previous performance metrics will also be taken into account during the evaluation.

Document Submission Details

All tender documents must be submitted electronically via the designated procurement portal. Vendors are advised to ensure that their submission is complete and in the specified formats. Late submissions will not be considered.

Special Provisions

The tender allows benefits for Micro, Small, and Medium Enterprises (MSEs) and acknowledges startup companies. This encourages participation from smaller vendors and promotes local business growth in alignment with 'Make in India' initiatives.

Evaluation Process

The evaluation process will be conducted based on a combination of both technical capabilities and financial offerings. Preference may be given to bidders demonstrating a robust history in providing quality motor insurance services.

Delivery Locations

Insurance services will cover vehicles operating under the jurisdiction of the Bhakra Beas Management Board. The operational geography aligns with the Ministry's guidelines.

Contact Information

While specific contact details are not published within the tender documentation, interested parties are encouraged to visit the official website of the Bhakra Beas Management Board for further information and clarification.

This document provides an outline of the tender parameters and facilitates a common understanding of the expectations and requirements for prospective bidders. Interested parties are encouraged to engage proactively to secure high-value contracts that not only meet compliance benchmarks but elevate the service delivery standards in the region.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

5 DocumentsDocuments Required from Seller

- Certificate (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity with licenses for motor insurance, a proven track record in similar services, and adherence to applicable local regulations. Vendors must demonstrate adequate financial standing and relevant experience in providing quality insurance services.

Bidders must possess relevant certifications such as the Insurance Regulatory and Development Authority (IRDAI) license, along with any documents that affirm their capability to deliver motor insurance services. Compliance certificates detailing adherence to quality standards and technical ability should also be provided.

Vendors interested in submitting a proposal must register through the designated procurement portal, following the required steps laid out in the tender document. Registration should include all necessary documentation to establish eligibility and compliance with the tender requirements.

The payment terms will be detailed in the tender documentation, typically involving structured installments based on service delivery milestones. It is important to review the specific conditions attached to payment and ensure alignment with the overall financial proposal.

Micro, Small, and Medium Enterprises (MSEs) and startups stand to benefit from relaxed eligibility criteria, potential financial incentives, and preference in the evaluation process. This encourages innovation, enhances local participation, and aligns with national policies aimed at bolstering the entrepreneurial ecosystem in insurance and allied services.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders