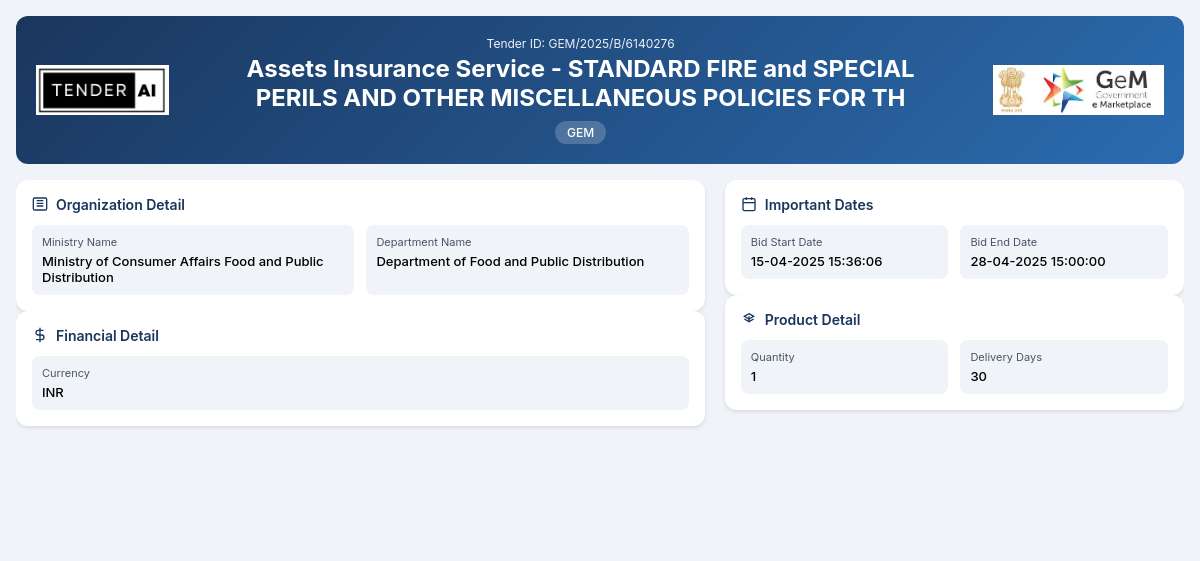

Department of Food and Public Distribution Tender by Central Warehousing Corporation (cwc) (GEM/2025/B/6140276)

Assets Insurance Service - STANDARD FIRE and SPECIAL PERILS AND OTHER MISCELLANEOUS POLICIES FOR TH

Tender Timeline

Tender Title: Assets Insurance Service - STANDARD FIRE and SPECIAL PERILS AND OTHER MISCELLANEOUS POLICIES

Tender Reference Number: GEM/2025/B/6140276

Issuing Authority/Department: Department of Food and Public Distribution, Ministry of Consumer Affairs, Food and Public Distribution

The Department of Food and Public Distribution is pleased to announce the tender for Assets Insurance Service covering STANDARD FIRE and SPECIAL PERILS along with various other miscellaneous policies. This tender seeks qualified vendors to provide effective insurance services for the period specified in the tender documentation.

Scope of Work and Objectives

The primary objective of this tender is to insure valuable assets against standard fire risks, special perils, and miscellaneous contingencies. The successful bidder will be responsible for providing comprehensive insurance cover to ensure that the assets within the department are adequately protected against inevitable risks, enabling smooth operations without the burden of unforeseen financial losses. The scope includes evaluating the insured assets, preparing appropriate insurance packages, and managing claims effectively.

Eligibility Criteria

To qualify for this tender, potential bidders must meet various eligibility criteria:

- Registration as an entity within the insurance sector.

- A proven track record in delivering insurance services tailored to government departments.

- Adequate financial stability and resource capacity to handle the services required.

Technical Requirements

Bidders are required to comply with stringent technical specifications for insurance coverage that includes:

- Detailed understanding of fire risks and special perils associated with government assets.

- Capability to offer custom insurance packages that meet the specific needs of the Department.

- Provision of comprehensive policy documents outlining terms, coverage limits, and exclusions.

Financial Requirements

All bidders must demonstrate financial solvency and the ability to provide competitive pricing for the offered insurance services. Each proposal should include detailed breakdowns of premium costs and any applicable fees associated with policy issuance or claims processing.

Document Submission Details

Bidders must submit their proposals and all required documents in the specified format as outlined in the tender documentation. Submissions should be comprehensive and clearly demonstrate how the bidder meets all eligibility criteria and requirements. Proposals can be submitted electronically through the designated platform as per the instructions provided.

Special Provisions

This tender encourages participation from Micro, Small, and Medium Enterprises (MSEs) and start-ups. Provisions have been made to facilitate their participation, allowing a competitive edge in the bidding process. MSEs are particularly encouraged to apply as they may benefit from relaxed eligibility criteria and potentially favorable evaluation conditions.

Evaluation Process

The evaluation of proposals will be rigorous, focusing on both technical and financial aspects:

- Each submission will undergo a comprehensive review, scoring technically compliant offers against pre-defined metrics.

- Price evaluation considerations will also factor into decisions, ensuring that the best overall value is achieved for the government.

Delivery Locations

Successful bidders will be required to coordinate with various locations as specified by the Department. The insurance services are intended for assets located throughout the jurisdiction of the Ministry of Consumer Affairs, Food and Public Distribution.

Contact Information

For additional information regarding this tender, bidders are encouraged to contact the designated officials within the department. Please reference the assigned tender number in all correspondence to ensure efficient communication.

This tender represents a vital opportunity for qualified insurance service providers to contribute impactful solutions that safeguard vital public assets while promoting a competitive bidding environment.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

6 DocumentsDocuments Required from Seller

- Additional Doc 1 (Requested in ATC)

- Additional Doc 2 (Requested in ATC)

- Additional Doc 3 (Requested in ATC)

- Additional Doc 4 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Corrigendum Updates

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity within the insurance sector, demonstrating a robust experience with government contracts, and delivering security against relevant perils. Bidders must also showcase financial stability and the capability to meet the department’s specific insurance needs.

Bidders need to provide certain essential certificates, including registration with relevant insurance and regulatory bodies, proof of financial solvency, and certifications demonstrating compliance with applicable insurance laws and regulations. These certificates should substantiate the bidder’s capability and reliability in providing the required services.

To submit the tender bid, vendors must follow the detailed submission methods outlined in the tender documentation. Bids should be submitted electronically via the designated platform, ensuring adherence to the specified format. All required supporting documents must accompany the bid to ensure completeness and compliance.

Payment terms for the services to be provided under this tender typically will be outlined in detail within the proposed agreement. Bidders should prepare for discussions related to premium payments, claims settlements, and any applicable deductions or fees during the initial negotiation phase.

Yes, there are special provisions aimed at benefiting Micro, Small, and Medium Enterprises (MSEs). These may include relaxed eligibility criteria, inclusion in a special evaluation category, and favorable payment terms. This approach encourages innovation and participation from smaller enterprises within the insurance sector, promoting a diverse bidding environment.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders