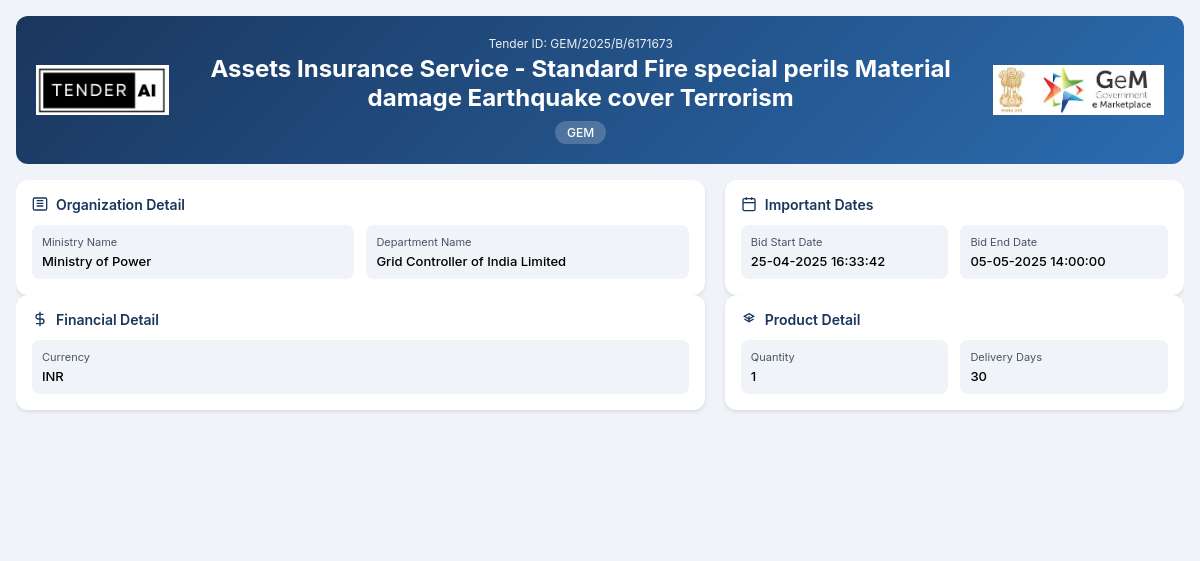

Grid Controller of India Limited Tender by Grid Controller Of India Limited (GEM/2025/B/6171673)

Assets Insurance Service - Standard Fire special perils Material damage Earthquake cover Terrorism

Tender Timeline

Tender Title: Assets Insurance Service - GEM/2025/B/6171673

Issuing Authority: Grid Controller of India Limited

Department: Ministry of Power

Scope of Work and Objectives

The objective of this tender is to secure comprehensive Assets Insurance Service covering a range of risks including standard fire, special perils, material damage, earthquake, terrorism, and burglary and housebreaking. The insurance services will provide extensive financial protection against various unforeseen events that may cause significant operational disruptions. The aim is to mitigate financial losses for the Grid Controller of India Limited through well-structured insurance coverage.

Eligibility Criteria

To qualify for this tender, bidders must meet the following eligibility criteria:

- Bidders must be registered entities licensed to offer insurance services in India.

- Prior experience in providing insurance services for public entities or large organizations is preferred.

- Bidders should have a valid registration with necessary regulatory bodies.

Technical Requirements

The technical requirements include:

- Insurance coverage that includes protection against fire, special perils, earthquake, terrorism, and burglary.

- The total sum insured should be at least Rs 10,000,000 for any one accident with adequate coverage for individual items.

- Policies must comply with relevant legislation and industry standards.

Financial Requirements

Bidders must present proof of financial stability and capacity to carry out the obligations defined in the tender. This includes:

- Submission of financial statements for the last three years.

- Evidence of solvency ratio that meets the regulatory guidelines set forth by the Insurance Regulatory and Development Authority of India (IRDAI).

Document Submission Details

All tenders must be submitted electronically through the designated portal. Required documents include:

- Completed tender response forms.

- Supporting documentation verifying eligibility criteria and technical capacity.

- Proof of experience and financial credibility.

Special Provisions

Micro, Small, and Medium Enterprises (MSE) and startups may benefit from reserved opportunities within this tender, fostering inclusiveness in participation. This will be in accordance with applicable government provisions aimed at enhancing competitiveness and participation of small enterprises.

Evaluation Process

The evaluation of bids will follow a comprehensive methodology based on:

- Compliance with technical specifications and requirements.

- The bidders’ experience and financial soundness.

- Pricing considerations marked against the benchmarks set forth in the tender specifications.

Delivery Locations

Services rendered as part of this tender will primarily cater to locations authorized by the Grid Controller of India Limited across India, ensuring full coverage of the entity's operational territories.

Contact Information

For further inquiries, prospective bidders are encouraged to reach out to the official contact channel through the designated communication channels specified in the tender documentation.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

5 DocumentsSimilar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity with a valid license to provide insurance services within India. Bidders should demonstrate prior experience dealing with public entities, alongside proper registration with necessary regulatory bodies.

The technical specifications mandate that the insurance coverage must include protection against specified risks such as fire, special perils, and terrorism. Policies should also ensure adequate coverage amounts with a total sum insured of at least Rs 10,000,000 for any one accident and comply with standard industry practices and government regulations.

Participants are required to submit an Earnest Money Deposit (EMD) as a show of seriousness towards the bid submission. The exact amount and submission process will be detailed in the tender documents, and it is crucial for bidders to comply with this requirement to ensure eligibility.

Bidders must submit their proposals online via the designated e-tendering portal. Required documents including the tender response and supporting documentation must be prepared in compliance with submission guidelines specified in the tender documentation.

Yes, there are specific provisions aimed at benefiting Micro, Small, and Medium Enterprises (MSEs). These provisions are designed to facilitate greater participation and support for small enterprises, thus enhancing inclusivity in the bidding process in alignment with the government’s initiatives for MSE empowerment.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders