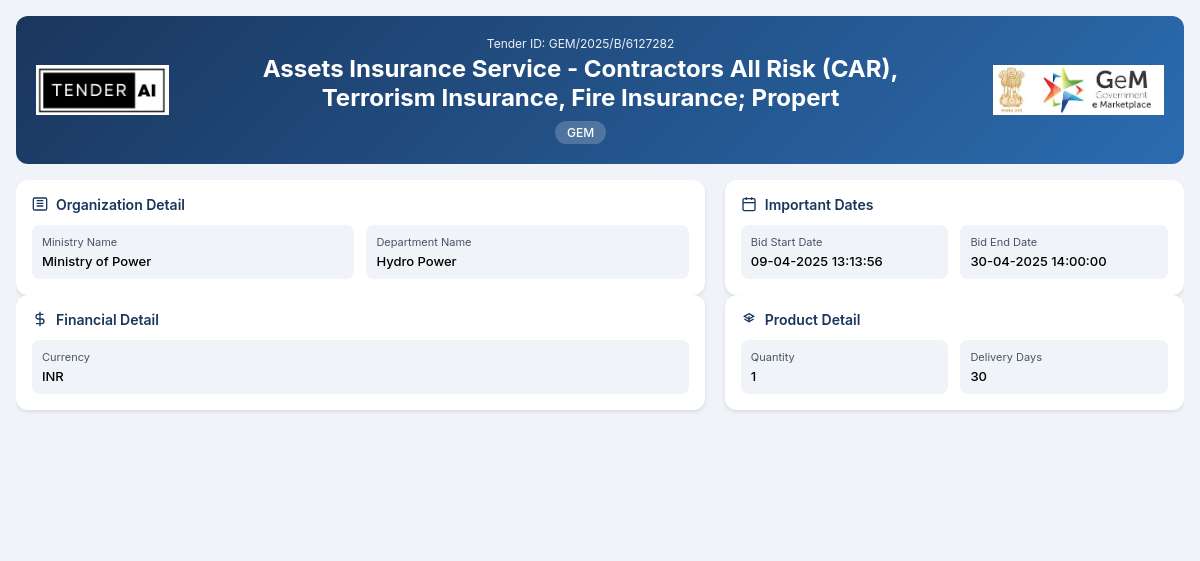

Hydro Power Tender by North Eastern Electric Power Corporation Limited (GEM/2025/B/6127282)

Assets Insurance Service - Contractors All Risk (CAR), Terrorism Insurance, Fire Insurance; Propert

Tender Timeline

Tender Title: Assets Insurance Service - Contractors All Risk (CAR), Terrorism Insurance, Fire Insurance; Property Damage Cover

Tender Reference Number: GEM/2025/B/6127282

Issuing Authority: Ministry of Power, Hydro Power Department

The Assets Insurance Service tender focuses on securing comprehensive insurance solutions. The scope of work encompasses the provision of several types of insurance coverage including Contractors All Risk (CAR), Terrorism Insurance, Fire Insurance, and various property damage covers like Standard Fire & Special Perils Cover, Storm, Typhoon, Hurricane, Tornado, Flood, and Inundation (STFI) Cover, as well as Earthquake Covers. The goal of this tender is to ensure that stakeholders in the hydro power sector have adequate financial protection against potential risks associated with construction processes and natural calamities.

Scope of Work and Objectives

The successful bidder will deliver an all-encompassing Assets Insurance Service designed to protect against potential liabilities arising from both operational and environmental risks. This includes mitigating financial losses due to unforeseen incidents like natural disasters and acts of terrorism, facilitating business continuity for project activities.

Eligibility Criteria

Eligible bidders must be registered entities with a valid insurance license, possessing adequate experience in providing risk management services and insurance products specifically tailored for industrial projects. Proof of financial stability, including recent financial statements, is required to confirm the ability to underwrite significant exposure.

Technical Requirements

Bidders are expected to submit comprehensive technical documentation outlining their proposed insurance policies and coverage limits, strategies for risk assessment, and methodologies for client servicing and claims settlement. Familiarity with environmental regulations and compliance mandates is crucial.

Financial Requirements

Bidders should provide a detailed financial proposal that outlines premium structures, payment terms, and potential discounts for comprehensive policy bundles. It is essential that the financial documents demonstrate competitive pricing while ensuring robust coverage.

Document Submission Details

All proposals must be submitted electronically through the relevant procurement platform by the stated deadline. Documents should be formatted as PDF files, including all mandatory certificates and licenses stipulated in the tender documentation.

Special Provisions

This tender aims to encourage participation from Micro, Small, and Medium Enterprises (MSEs) and startups by allowing certain benefits in the bidding process. Special incentives may include relaxed eligibility criteria and additional scoring in the evaluation process to enhance competitive equity.

Evaluation Process

Bids will be evaluated based on a combination of technical proficiency and financial proposals. The committee will assess the qualifications of the bidding parties, ensuring that selected bidders meet all outlined requirements and demonstrate value-driven pricing strategies.

Delivery Locations

Insurance services will cover projects across various locations managed by the Hydro Power Department. Specific project sites will be outlined at the beginning of the insurance term based on the applicable construction projects active at that time.

Contact Information

For inquiries related to the tender, bidders may reach out to the Ministry of Power, Hydro Power Department. Please check the procurement platform for updated contact details.

Additional Information

Successful bidders will be advised on key timelines for policy initiation and claims processing guidelines throughout the contract duration. All participants are encouraged to review the available guidelines and standards to maximize their submission efficacy.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

5 DocumentsDocuments Required from Seller

- Certificate (Requested in ATC)

- Additional Doc 1 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity with a valid insurance license, demonstrating experience in providing risk management services tailored for industrial projects, and possessing financial stability evidenced by recent financial statements. Entities should also have a history of compliance with local regulations and standards in the insurance sector.

Bidders must provide a comprehensive technical proposal that outlines insurance policies and coverage limits. This includes demonstrating methodologies for risk assessment, client servicing, and claims settlement. Familiarity with compliance standards, environmental regulations, and specific industry practices is also essential to meet the technical specifications required.

Documents must be submitted electronically through the designated procurement platform. All proposals should be formatted in PDF files and must include mandatory certificates, licenses, technical proposals, and the financial documents detailed in the tender requirements. Adhering to submission guidelines ensures that bids comply with the evaluation criteria, enhancing the chances of selection.

Payment terms will reflect structures based on contract specifics, with performance security requirements outlined in the tender documents. Typically, bidders will need to provide a performance guarantee that secures the fulfillment of contract obligations, usually calculated as a percentage of the total contract value. Details will be provided upon award of the tender, ensuring clarity and compliance.

The tender encourages MSE participation by providing specific provisions such as relaxed eligibility criteria and additional evaluation points. This aims to foster inclusivity and competition among smaller entities, ensuring they can compete effectively with larger service providers. Moreover, compliance with ‘Make in India’ policies is supported to bolster local procurement initiatives and encourage domestic manufacturing.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders