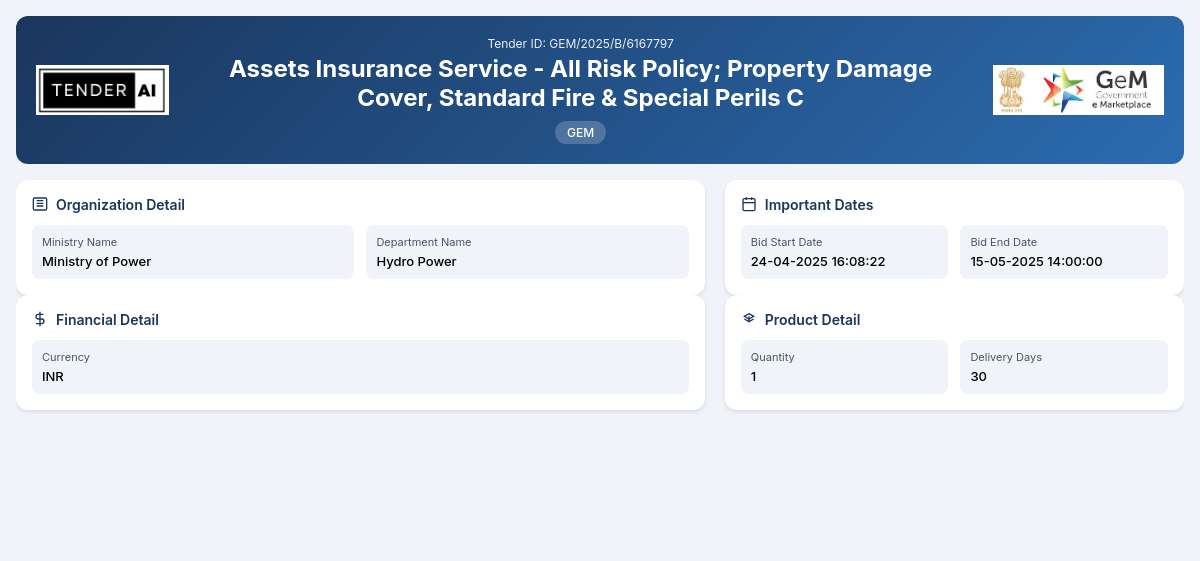

Hydro Power Tender by North Eastern Electric Power Corporation Limited (GEM/2025/B/6167797)

Assets Insurance Service - All Risk Policy; Property Damage Cover, Standard Fire & Special Perils C

Tender Timeline

Tender Title: Assets Insurance Service - All Risk Policy

Issuing Authority

The issuing authority for this tender is the Hydro Power department under the Ministry of Power.

Scope of Work and Objectives

The primary objective of this tender is to procure Assets Insurance Services encompassing an All Risk Policy. This includes coverage for property damage, standard fire and special perils, and other essential aspects such as storm, typhoon, hurricane, tornado, flood, inundation (STFI), business interruption (loss of profit), and machinery breakdown (MBD) coverage. The selected insurer will provide comprehensive protection against various risks associated with hydro power assets. The tender aims to ensure the safeguarding of valuable infrastructure and minimize the financial impact of unforeseen events affecting operations.

Eligibility Criteria

Bidders must meet specific eligibility criteria to participate in the tender. These include:

- Being a registered entity with valid certifications in insurance services.

- Proven experience in providing similar insurance covers in the past.

- Financial stability and capacity to underwrite large risks.

- Compliance with all regulatory requirements related to insurance services.

Technical Requirements

The bidders are required to demonstrate:

- A detailed proposal showcasing their ability to provide the specified insurance coverage.

- Evidence of compliance with industry-standard insurance underwriting practices.

- A detailed risk assessment and exposure evaluation related to hydro power assets.

- Adherence to applicable quality standards and regulations in insurance services.

Financial Requirements

Bidders should present:

- Competitive pricing models aligned with market rates.

- Evidence of the financial health, including relevant financial statements for the past three years.

- Proposals should include details on the payment terms and conditions associated with the policy coverage.

Document Submission Details

All documents must be submitted electronically via the established online tender submission platform. Bidders will need to ensure that all required documentation is complete and adheres to the specified formats provided in the tender guidelines.

Special Provisions

There will be special provisions for Micro, Small, and Medium Enterprises (MSEs) to encourage their participation in this tender. These provisions will ensure that MSEs benefit from enhanced opportunities within the insurance sector, promoting inclusivity and competition.

Evaluation Process

The evaluation process will be conducted based on the following criteria:

- Compliance with the eligibility and technical requirements.

- Pricing proposals and overall financial viability.

- Company reputation and past performance in similar contracts.

- The thoroughness of the risk assessment and coverage offered.

Delivery Locations

Insurance coverage will pertain to hydro power facilities and associated assets across various designated locations as specified by the authority. Bidders will need to identify and confirm their ability to cover all stated locations effectively.

Contact Information

For any inquiries regarding this tender, bidders may reach out using the contact information provided in the official tender documentation.

Conclusion

This tender is an exceptional opportunity for qualified insurance providers to offer comprehensive coverage solutions tailored to the specific needs of hydro power assets. Interested bidders are encouraged to prepare detailed proposals that align with the outlined scope and objectives to ensure a competitive and compliant submission.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

5 DocumentsDocuments Required from Seller

- Certificate (Requested in ATC)

- Additional Doc 1 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity, compliant with local insurance regulations, and demonstrating experience in providing asset insurance services. Bidders must also present financial statements showcasing their ability to underwrite substantial risks and must meet the technical and quality standards specified in the tender document.

To fulfill the required certificates for this tender, bidders must provide valid insurance licenses, proof of active membership in relevant insurance associations, and any additional certifications emphasizing their compliance with regulatory standards. Having ISO certification related to quality management may also be advantageous.

The submission process for this tender requires bidders to use the dedicated online platform provided for electronic submissions. All documents must be submitted in the specified formats outlined in the tender, ensuring that all criteria are met to avoid disqualification.

Bidders must comply with the quality standards relevant to the insurance industry, ensuring their proposal meets industry best practices and regulatory frameworks. This includes adherence to standards set by governing bodies for insurance providers.

The tender provides benefits for Micro, Small, and Medium Enterprises (MSEs), including relaxed eligibility criteria, opportunities for preferential pricing, and incentives aimed at fostering inclusive participation in the procurement process. Additionally, the provisions encourage MSEs to showcase their capacity in delivering insurance services effectively.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders