Hydro Power Tender by North Eastern Electric Power Corporation Limited (18c8fc4a6)

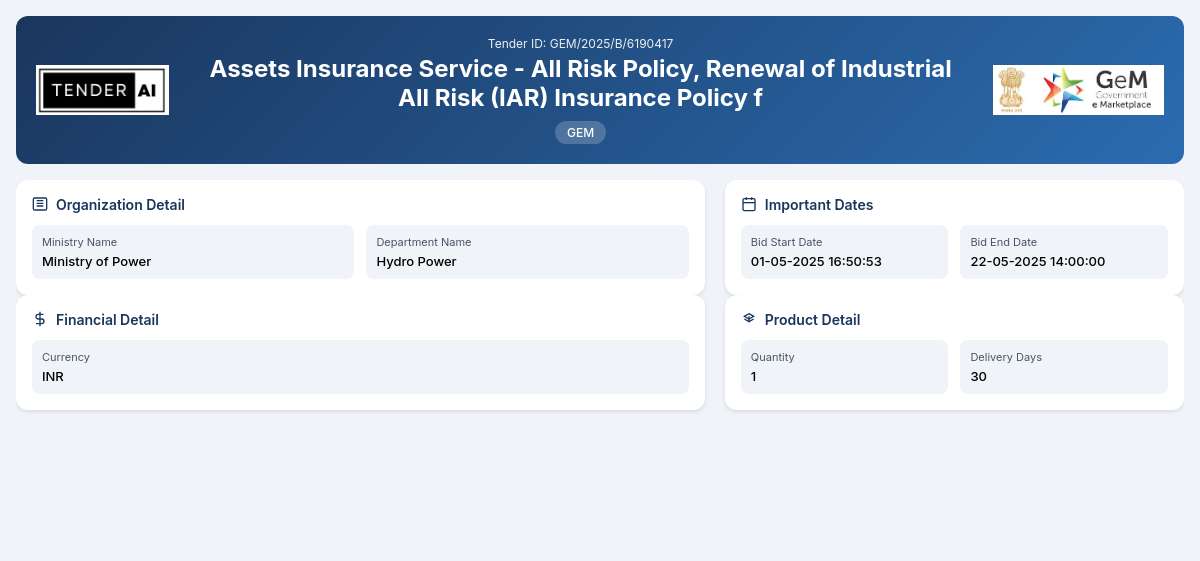

Assets Insurance Service - All Risk Policy, Renewal of Industrial All Risk (IAR) Insurance Policy f

Tender Timeline

Tender Title: Assets Insurance Service - All Risk Policy, Renewal of Industrial All Risk (IAR) Insurance Policy for Monarchak Solar Power Station

Tender Reference Number: 18c8fc4a6

Issuing Authority

The issuing authority for this tender is the Ministry of Power, specifically under the Hydro Power department.

Scope of Work and Objectives

This tender pertains to the procurement of Assets Insurance Service for the Monarchak Solar Power Station, which is a 5 MW facility located in Monarchak, Tripura. The primary objective of this tender is to acquire an Industrial All Risk (IAR) Insurance Policy for a period of one year. This includes the essential coverage for property damage, standard fire, and special perils associated with the operation of the solar power station. The contractor will be responsible for ensuring that all assets under this policy are adequately insured against various risks that may affect their functionality.

Eligibility Criteria

Eligible bidders must be registered insurance firms with a valid license to operate in the region. They must demonstrate prior experience in providing insurance services for industrial assets and comply with all statutory requirements related to insurance practices.

Technical Requirements

Bidders are required to submit technical documents that outline their insurance proposals, particularly focusing on the coverage terms, risk management strategies, and the scope of services included in the policy. Assurance of compliance with standard industry practices and customer satisfaction must be reflected in the technical documentation.

Financial Requirements

Bidders will be required to present detailed financial proposals, including the premium rates for the insurance policy, payment terms, and any additional fees that may be incurred during the policy's duration. The financial proposal must be clearly structured to facilitate an evaluation of the total cost of ownership.

Document Submission Details

All documents related to the bid must be submitted electronically through the designated procurement portal. Bidders will need to ensure that their submissions are complete and adhere to the guidelines outlined in the tender documentation to qualify for consideration.

Special Provisions

This tender encourages participation from Micro, Small, and Medium Enterprises (MSEs) and may offer benefits under government programs aimed at promoting local establishments. Startups may receive specific considerations during the evaluation process, aligning with initiatives designed to facilitate their inclusion in governmental tenders.

Evaluation Process

The evaluation of submissions will take place in a structured format, assessing both technical and financial criteria. Bidders must meet the minimum requirements established in the technical evaluation to proceed to the financial review. The final selection will prioritize bidders who demonstrate competitiveness in pricing while maintaining comprehensive coverage within their insurance proposals.

Delivery Locations

Services will primarily be delivered at the Monarchak Solar Power Station site, located in Tripura. Successful bidders must ensure timely activation of the insurance policy to cover risks associated with the facility during the operational term.

Contact Information

For further inquiries related to this tender, bidders may refer to the official procurement portal or contact the Ministry of Power's Hydro Power department directly as per the established communication protocols.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

5 DocumentsDocuments Required from Seller

- Certificate (Requested in ATC)

- Additional Doc 1 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements for this insurance tender include being a registered and licensed insurance company capable of providing Assets Insurance Service. Bidders should have a track record in insurance services for industrial assets, showcasing compliance with legal standards and financial stability. Experience in similar contracts will enhance eligibility.

Submissions for this tender must include vital certificates such as the company’s registration, insurance provider licenses, and any relevant certifications proving expertise in the industrial risk sector. Detailed financial statements and previous work references should also be presented.

To register for this tender, bidders must create an account in the designated procurement portal. This includes filling out required forms and uploading supporting documents such as company registration details, proof of eligibility, and relevant experience. Ensure that all documents are in accepted formats for smooth processing.

Payment terms for the insurance policy will be outlined in the financial proposal and must detail the premium payments schedule. Typically, premium rates may be provided either upfront or as installment payments, based on mutual agreement during contract finalization.

The evaluation and selection process involves both technical and financial assessment. Bidders must fulfill technical benchmarks before their financial proposals are reviewed. The process is designed to ensure that the most competitively priced and qualified provider is selected, emphasizing quality insurance coverage for the project’s duration.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders