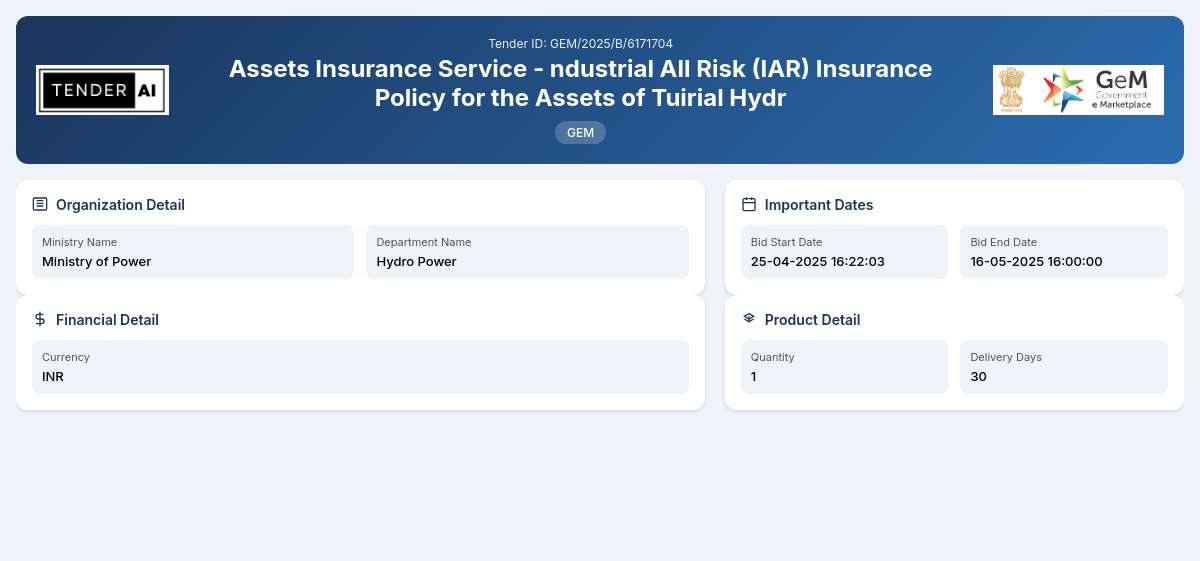

Hydro Power Tender by North Eastern Electric Power Corporation Limited (GEM/2025/B/6171704)

Assets Insurance Service - ndustrial All Risk (IAR) Insurance Policy for the Assets of Tuirial Hydr

Tender Timeline

Tender Title: Assets Insurance Service - Industrial All Risk (IAR) Insurance Policy for the Assets of Tuirial Hydro Power Station

Reference Number: GEM/2025/B/6171704

Issuing Authority/Department

The tender is issued by the Ministry of Power, specifically from the Hydro Power division.

Scope of Work and Objectives

This tender encompasses the provision of Assets Insurance Service under an Industrial All Risk (IAR) insurance policy. The primary objective is to cover the assets of the Tuirial Hydro Power Station, located in Tuirial, Mizoram, with a capacity of 60 MW. The successful bidder will be responsible for providing comprehensive property damage coverage, including but not limited to Standard Fire and Special Perils Cover, as well as coverage from unpredictable natural calamities such as storms, typhoons, hurricanes, floods, etc.

Eligibility Criteria

Bidders must meet specific eligibility requirements to qualify for this tender. They should be registered entities in India with prior experience in providing similar insurance services. Adequate financial stability and capacity to handle the scope of the work outlined in this tender are also required.

Technical Requirements

Technical specifications will include adherence to industry standards and regulations relevant to the insurance sector. Providers are expected to have a demonstrated history of fulfilling similar contracts and should be licensed under the relevant laws governing insurance in India.

Financial Requirements

Bidders must provide valid financial documents to demonstrate their ability to fulfill the financial obligations of this contract. This includes any necessary Earnest Money Deposit (EMD) as stipulated in the tender conditions. The specifics of the financial proposals should be clear and comply with the Ministry's guidelines.

Document Submission Details

All documentation required for bidding must be submitted via the designated portal. Documents should be in acceptable formats which will be outlined in the detailed tender guidelines.

Special Provisions

The tender may include provisions that favor Micro, Small, and Medium Enterprises (MSEs) and startups, promoting their participation in government tenders. These provisions aim to support and enhance the involvement of smaller businesses.

Evaluation Process

The evaluation process will be clearly outlined, including criteria for assessing bidder qualifications, technical capabilities, and financial proposals. The process will focus on ensuring transparency and fairness in the selection of the winning bid.

Delivery Locations

The insurance services will be specifically tailored to cover the assets located at the Tuirial Hydro Power Station in Mizoram.

Contact Information

For any inquiries regarding this tender, bidders may need to refer to further documentation or the official contact points provided within the tender portal terms.

Additional Information

The tender also calls for compliance with predefined standards within the Indian insurance policy framework. It encourages a local approach where possible, fostering greater community and economic growth.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

6 DocumentsDocuments Required from Seller

- Bidder Turnover

- Certificate (Requested in ATC)

- Additional Doc 1 (Requested in ATC)

- Additional Doc 2 (Requested in ATC)

- Additional Doc 3 (Requested in ATC)

- Additional Doc 4 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity in India, capable of providing Industrial All Risk (IAR) insurance services. Participants should have previous experience with similar contracts, ensuring they possess the necessary skills and expertise for this specific project. Financial stability is also a factor, with successful bidders expected to provide proof of their financial health. Entities should comply with local laws governing insurance and have valid licenses.

Bidders must present specific certificates, which include valid licenses issued by the Insurance Regulatory and Development Authority of India (IRDAI). Applicants should also have documentation that demonstrates prior experience in handling property damage and related insurance services, along with any financial statements reflecting adherence to industry standards.

Proposals must be submitted through the official e-tendering platform as specified in the tender documentation. Accepted document formats typically include PDF, Word Documents, and Excel files, ensuring that submissions are easily accessible and reviewable. It is crucial for bidders to adhere to these formats to avoid disqualification due to technicalities.

Payment terms for the insurance policy will follow standard practices as outlined in the tender specifications. Typically, successful bidders will be required to discuss payment schedules, which might be linked to milestone achievements or annual premiums paid upfront. Clarity in these arrangements is essential to maintain financial compliance and to ensure effective service delivery.

Yes, the tender includes special provisions that favor Micro, Small, and Medium Enterprises (MSEs) and incentivizes participation from startups. These benefits may take the form of reduced fees, simpler qualification requirements, or additional points in the evaluation process. This initiative underscores the government’s commitment to empowering smaller enterprises, supporting their growth and integration into national projects.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders