Tender Timeline

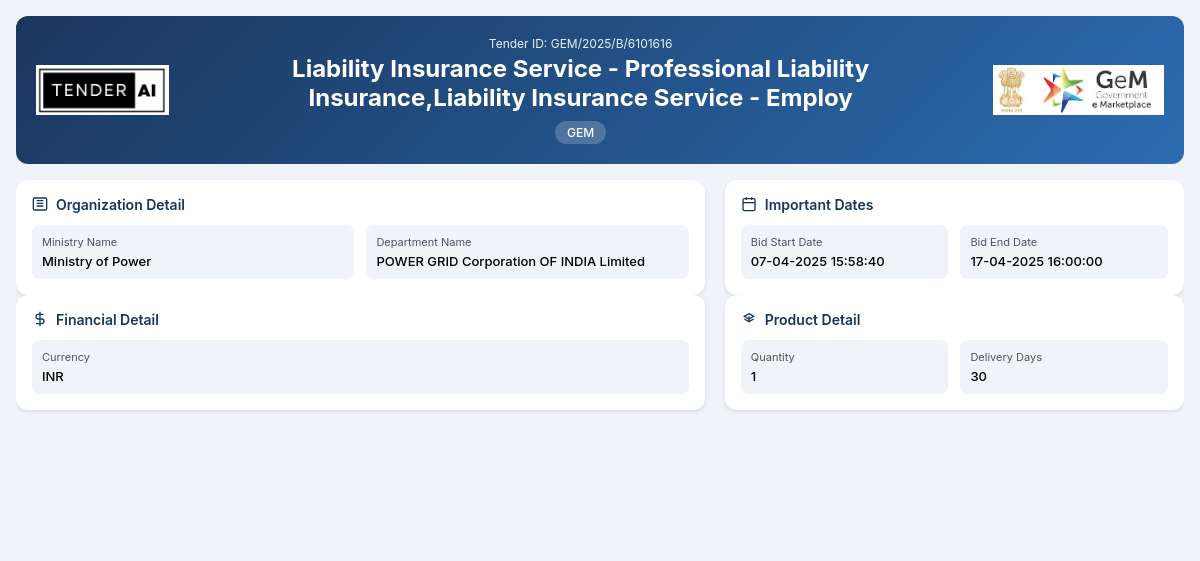

Tender Title: Liability Insurance Services

Reference Number: GEM/2025/B/6101616

Issuing Authority/Department

- POWER GRID Corporation OF INDIA Limited

- Under the auspices of the Ministry of Power

Scope of Work and Objectives

The Liability Insurance Services tender aims to procure a comprehensive suite of insurance products designed to cover various liability aspects, specifically professional liability, employer's liability, workers' compensation, and third-party liability insurance. The objective is to ensure adequate risk management for the department against potential claims arising from activities associated with its operational mandates. Bidder firms are expected to propose effective insurance solutions that meet the unique needs of the POWER GRID Corporation, enhancing its operational resilience while conforming to statutory obligations.

Eligibility Criteria

Eligible bidders must be registered legal entities with capability in providing insurance services. They should possess valid licenses and approvals mandated under Indian law for offering such insurance products. Further, bidders are expected to demonstrate previous experience in handling similar contracts, showcasing a portfolio of success in liability insurance provision.

Technical Requirements

Bidders must meet the following technical specifications:

- Comprehensive insurance policy that includes professional liability, employer's liability, and third-party liability coverage.

- Capacity to cover a diverse range of risks associated with the projects undertaken by POWER GRID Corporation.

- Must comply with all relevant legal and regulatory standards established by Indian jurisprudence governing insurance services.

- Submission of detailed technical descriptions of the proposed insurance products, along with illustrative cases demonstrating adequacy and effectiveness.

Financial Requirements

Those participating must exhibit sound financial health, evidenced by financial statements from the last three fiscal years. Insurance premium proposals should be detailed, with clear payment terms and previous claim history. Bidders need to include an Earnest Money Deposit (EMD) as stated in the bid document, ensuring financial commitment.

Document Submission Details

Proposals must be submitted electronically through the designated bidding platform. Required documents include:

- Completed Bid Form

- Proof of eligibility (licenses, registrations, etc.)

- Technical proposal with insurance details

- Financial bid with breakdown costs

- Recent financial statements

Special Provisions

Provisions favoring Micro, Small, and Medium Enterprises (MSEs) are available, facilitating participation in the bidding process. Startups may also avail benefits in terms of support to enter this competitive sector.

Evaluation Process

Proposals will undergo a transparent evaluation process, emphasizing both technical competence and cost-effectiveness. The evaluation criteria will prioritize the most compliant bids in affecting risk coverage, historical performance, and responsiveness to tender requirements.

Delivery Locations

Insurance services must cover liabilities arising from operations at multiple locations managed by POWER GRID Corporation across India. Specific locations will be communicated upon the bid's acceptance.

Contact Information

For further clarification regarding the tender, interested parties should refer to the POWER GRID Corporation’s official website or their designated contact point for assistance.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

4 DocumentsDocuments Required from Seller

- Certificate (Requested in ATC)

- Additional Doc 1 (Requested in ATC)

- Additional Doc 2 (Requested in ATC)

- Additional Doc 3 (Requested in ATC)

- Additional Doc 4 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Corrigendum Updates

Similar Tenders

Frequently Asked Questions

The eligibility requirements for participating in this tender include being a legally registered entity capable of offering liability insurance services. Interested bidders must hold valid licenses for insurance provision under Indian law. Additionally, they should demonstrate prior experience in managing similar contracts, showcasing successful implementations of relevant insurance policies.

Bidders must include various certificates with their submissions, such as:

- Valid insurance licensure.

- Registration under the Insurance Regulatory and Development Authority of India (IRDAI).

- Certificates evidencing compliance with local laws and regulations. These documents assure that the bidder fulfills legal requirements for offering insurance services.

The registration process involves completing a bid submission through the given online portal. Bidders need to register their details, upload required documents, and provide their technical and financial proposals as outlined in the tender documentation. Ensure adherence to the prescribed formats and guidelines for successful registration.

The tender requires bidders to provide detailed payment terms, which typically include aspects like upfront premiums, payment schedules, and related service fees. An Earnest Money Deposit (EMD) is mandated as a sign of commitment to the bidding process, while successful bidders may also need to furnish a performance security as stipulated in the tender documents.

Yes, the tender contains special provisions designed to encourage participation by Micro, Small, and Medium Enterprises (MSEs). These provisions aim to level the playing field, allowing smaller firms to compete effectively by providing necessary support and easing regulatory burdens. Additionally, startups may find tailored benefits that can assist them in navigating the bidding landscape while adhering to ‘Make in India’ policies.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders