Tender Timeline

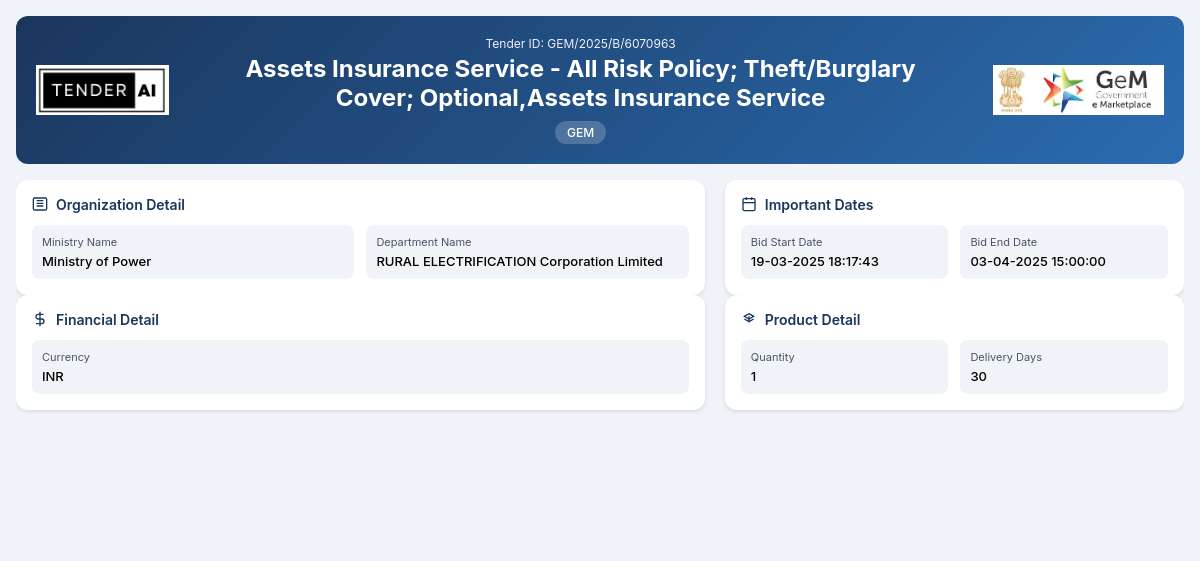

Tender Title: Assets Insurance Service

Reference Number: GEM/2025/B/6070963

Issuing Authority/Department:

RURAL ELECTRIFICATION Corporation Limited

Scope of Work and Objectives:

The purpose of this tender is to procure comprehensive Assets Insurance Services for the RURAL ELECTRIFICATION Corporation Limited, under the Ministry of Power. The scope includes coverage for various risks such as All Risk Policy, Theft/Burglary, Machinery Breakdown, Terrorism, Natural Disasters (e.g., Earthquake, Storm, Flood), and additional Special Perils. The objective is to safeguard the corporation's assets against unpredictable events, ensuring operational continuity and risk mitigation.

Eligibility Criteria:

To qualify for participation in this tender, bidders must be registered entities capable of offering the required Assets Insurance Services. Participants should possess relevant licenses and certifications to conduct insurance operations, along with a demonstrated experience in handling similar projects.

Technical Requirements:

Bidders must meet specific technical requirements in accordance with industry standards for insurance provision. This includes providing proof of possessing the necessary skills, tools, and resources to execute the insurance contract effectively. Companies should maintain compliance with applicable regulatory frameworks and legislative requirements in the insurance sector.

Financial Requirements:

Submissions must include detailed financial statements that demonstrate the bidder's capability to deliver the insurance services specified. Additionally, bidders should adhere to the financial frameworks that highlight effective pricing strategies, ensuring competitive yet sustainable rates for the services provided.

Document Submission Details:

Bidders are required to submit their proposals electronically via the official portal. All documentation must be submitted in a suitable format (PDF, DOC). A checklist detailing the requisite documents must accompany the submission for clarity and compliance.

Special Provisions:

The tender holds special provisions supportive of Micro, Small, and Medium Enterprises (MSEs) and offers incentives for startups. These measures are aimed at encouraging participation from smaller entities to enhance competition and diversity within the insurance market.

Evaluation Process:

The evaluation of bids will be based on criteria such as price competitiveness, technical compliance, experience, and delivery timelines. A transparent scoring system will be implemented to assess all proposals fairly, ensuring that selected bidders meet the corporation's objectives and expectations.

Delivery Locations:

Assets Insurance Services are to be delivered across various operational locations defined by the RURAL ELECTRIFICATION Corporation Limited. Specific site requirements will be clarified in the tender documents.

Contact Information:

For inquiries regarding this tender, bidders may refer to the official contact details provided in the tender documents. However, please refrain from disseminating misrepresented information.

Conclusion:

This tender represents an excellent opportunity for firms specializing in Assets Insurance Services to partner with RURAL ELECTRIFICATION Corporation Limited, facilitating risk management and asset protection in alignment with government initiatives. Bidders are encouraged to carefully review the requirements and ensure compliance in their submissions.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

4 DocumentsDocuments Required from Seller

- Experience Criteria

- Certificate (Requested in ATC)

- Additional Doc 1 (Requested in ATC)

- Additional Doc 2 (Requested in ATC)

- Additional Doc 3 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Corrigendum Updates

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity with valid licenses to provide Assets Insurance Services. Bidders must demonstrate relevant experience in the insurance sector and adherence to regulatory standards. Additionally, a strong financial standing and capability to manage the significant financial aspects associated with insurance contracts are crucial for qualification.

Participants must submit comprehensive documents, including proof of registration, relevant insurance licenses, technical qualifications, and financial statements. All documents should adhere to the specified guidelines, which include acceptable formats like PDF and DOC for clarity and compliance during the evaluation process.

Payment terms will be specified in the tender documentation, outlining key conditions including any initial deposits, milestones for interim payments, and final settlement protocols. Companies should anticipate timelines and payment structures that align with service delivery and completion of contracted services.

Bids will be evaluated via a structured scoring system that takes into account technical merit, price competitiveness, vendor experience, and adherence to submission guidelines. By focusing on these criteria, the evaluation process ensures the selection of the most capable bidders who can fulfill the Assets Insurance Services contract requirements effectively.

The tender encourages participation from Micro, Small, and Medium Enterprises (MSEs) by offering specific benefits aimed at increasing equality and competition within the bidding process. This includes relaxed eligibility criteria, potential financial incentives, and support mechanisms designed to facilitate MSE participation in government contracts, contributing to the broader economic growth objectives.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders