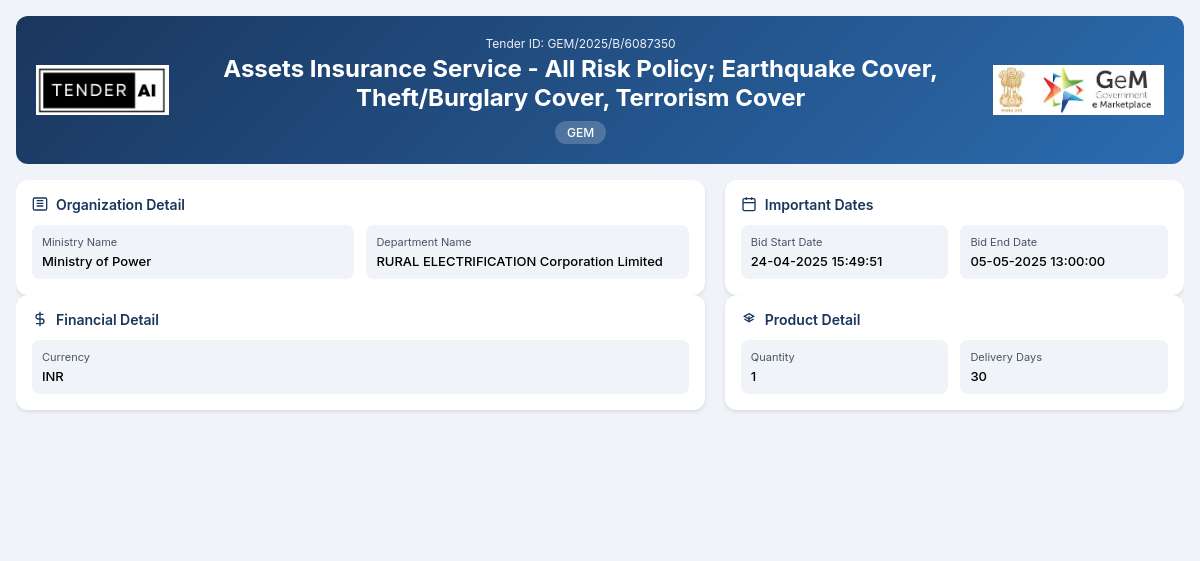

RURAL ELECTRIFICATION Corporation Limited Tender by Rural Electrification Corporation Limited (GEM/2025/B/6087350)

Assets Insurance Service - All Risk Policy; Earthquake Cover, Theft/Burglary Cover, Terrorism Cover

Tender Timeline

Tender Title: Assets Insurance Service - All Risk Policy

Tender Reference Number: GEM/2025/B/6087350

Issuing Authority/Department: Rural Electrification Corporation Limited under the Ministry of Power

The Assets Insurance Service - All Risk Policy tender aims to secure comprehensive insurance coverage for a diverse range of assets managed by the Rural Electrification Corporation Limited. This contract will include policies for Earthquake Cover, Theft/Burglary Cover, Terrorism Cover, and additional protections against natural disasters such as Storms, Typhoons, Hurricanes, Tornadoes, Floods, and Inundations, as well as Property Damage and Standard Fire & Special Perils Cover.

Scope of Work and Objectives

The core objective of this tender is to provide enhanced security for assets through a robust insurance policy framework. Participants will be expected to design and propose insurance packages that meet the specified requirements, ensuring optimal coverage while maintaining compliance with national insurance regulations.

Eligibility Criteria

To be eligible to participate in this tender, bidders must meet certain eligibility criteria that include:

- Being a legally registered entity within the insurance sector.

- Demonstrating a proven track record of similar insurance services provided in the past.

- Possessing relevant licenses and certifications as mandated by governmental regulations.

Technical Requirements

The bidders are required to technically specify their insurance solutions to cover the following:

- Comprehensive All Risk Insurance policies.

- Specific clauses for natural disasters including; Earthquake, Theft, and Terrorist acts.

- Compliance with standard insurance practices and formulations as dictated by legal entities.

Financial Requirements

Financial proposals submitted must include:

- Detailed pricing for each coverage option.

- Clear explanations related to premium payments and terms of coverage.

- Consideration of flexibility in pricing structures, particularly in response to varying asset values.

Document Submission Details

Interested bidders need to prepare and submit their bids along with all necessary documentation including:

- A detailed proposal outlining the policy structure.

- Certificates of eligibility and compliance.

- Any applicable financial statements to demonstrate capability and stability.

Special Provisions

This tender may provide special provisions that incentivize bids from Micro, Small, and Medium Enterprises (MSEs) and startups. These benefits aim to encourage participation from smaller entities and support the Make in India initiative.

Evaluation Process

The evaluation process will include a thorough review of technical proposals, financial offerings, and compliance with stipulated guidelines. The selection committee will assess bids based on predetermined evaluation criteria that emphasize quality, comprehensiveness of coverage, and pricing.

Delivery Locations

Insurance services will be applicable to specified locations as deemed necessary by the Rural Electrification Corporation Limited.

Contact Information

For further inquiries regarding this tender, interested parties may reach out to the Rural Electrification Corporation Limited. It's recommended to follow the official communication channels to ensure accurate information gathering.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

4 DocumentsDocuments Required from Seller

- Experience Criteria

- Bidder Turnover *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity with recognized insurance licenses. Bidders must demonstrate a capacity to deliver similar services previously, showcasing relevant experience and compliance with insurance regulations. Additionally, companies must comply with the guidelines set forth by the Ministry of Power and demonstrate financial stability through adequate documentation.

Bidders must provide certificates demonstrating their credentials to operate as an insurance provider. This includes relevant licenses, financial statements, as well as any compliance certificates that signify adherence to industry standards and government regulations. All submissions should be clear, concise, and well-organized to facilitate the evaluation process.

To register for the tender, interested firms must submit their proposals according to the guidelines set in the tender documentation. Accepted document formats typically include PDF or Word documents for proposals, while scanned copies of required certificates should be submitted in PDF. Ensure all documents are legible and formatted properly to avoid disqualification during the evaluation phase.

Payment terms will be detailed in the tender documentation and may vary according to the coverage options selected. Typically, performance security requirements will mandate a portion of the contract value held as a guarantee of service satisfaction. This amount is subject to the standard guidelines set out by the Ministry of Power and must be fulfilled before contract finalization.

MSEs may receive advantages including simplified qualification processes, support initiatives, or preferential treatment in evaluation processes. These benefits are designed to encourage participation from smaller enterprises under the Make in India initiative, promoting local content and fostering business opportunities within the sector.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders