Tender Title: Financial Advisory Services - Onsite; Financial Modelling

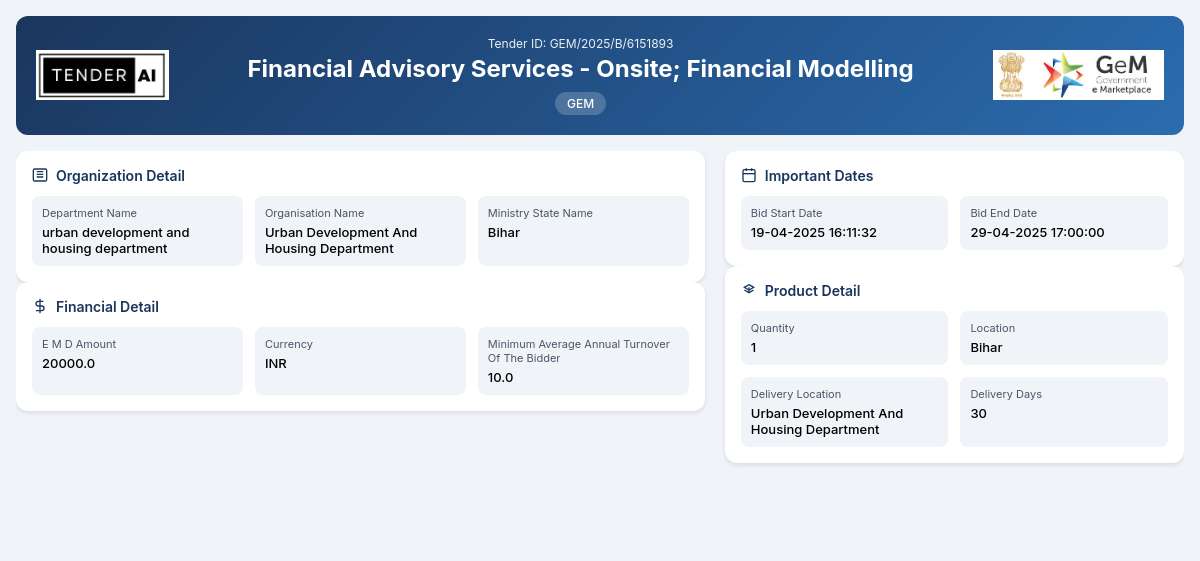

Reference Number: GEM/2025/B/6151893

Issuing Authority/Department: Urban Development and Housing Department

Scope of Work and Objectives:

The primary objective of this tender is to procure comprehensive financial advisory services encompassing onsite consultations and financial modelling. This project aims to enhance decision-making processes through detailed financial assessments, risk analysis, and revenue forecasting tailored to the specific requirements of Urban Development initiatives. The successful bidder is expected to provide expertise in structuring financial models that support strategic planning and program implementations.

Eligibility Criteria:

To qualify for this tender, interested parties must meet the following eligibility criteria:

- Be a legally registered entity under applicable laws.

- Have prior experience in providing financial advisory services and financial modelling in urban development or similar sectors.

- Display a capable team with certifications or degrees relevant to financial analysis and advisory.

Technical Requirements:

Participants must demonstrate:

- Proven methodologies in financial modelling and consulting.

- Robust analytical tools and software for developing financial forecasts.

- Ability to provide onsite support and guidance throughout the project's lifecycle.

Financial Requirements:

Proposals should include a detailed breakdown of the costs associated with the financial advisory services. The submitted bids must reflect a transparent pricing strategy, which includes all applicable taxes and overheads.

Document Submission Details:

Submissions must be prepared according to the guidelines provided in the tender documentation. All necessary documents, including qualifications, financial breakdowns, and methodologies, must be submitted electronically via the designated portal by the specified date.

Special Provisions:

This tender includes provisions benefitting Micro, Small, and Medium Enterprises (MSEs) and startups, encouraging them to participate actively. These entities may be provided advantages in the evaluation process to foster inclusivity and growth within the sector.

Evaluation Process:

The evaluation will be conducted based on the technical and financial proposals. The technical assessment will focus on the proposed methodologies, previous experience, and team qualifications, whereas the financial evaluation will assess the cost-effectiveness of bids.

Delivery Locations:

Services are to be rendered onsite at identified urban development projects throughout designated locations under the Urban Development and Housing Department's jurisdiction.

Contact Information:

For further inquiries and clarifications regarding the tender, interested parties can reach out to the Urban Development and Housing Department directly through the official communication channels listed on the departmental website.

This tender represents an opportunity for qualified firms to contribute substantially to urban development processes through expert financial guidance. Collaborative approaches that leverage innovative financial strategies are encouraged to enhance project outcomes.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

4 DocumentsDocuments Required from Seller

- Experience Criteria

- Bidder Turnover

- Certificate (Requested in ATC)

- Additional Doc 1 (Requested in ATC)

- Additional Doc 2 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a legally registered entity capable of delivering financial advisory services and financial modelling. Bidders must demonstrate relevant experience in the field, including past projects that relate to urban development. Furthermore, a qualified team with appropriate certifications is essential for consideration.

The proposal must detail robust methodologies for financial modelling and the use of advanced analytical tools. Additionally, bidders should outline their ability to provide onsite services, ensuring hands-on support involving risk analysis and financial assessments. Proposals should include any quality standards adhered to during service delivery.

Bidders may be required to submit an Earnest Money Deposit (EMD) as part of their proposal to ensure commitment. The EMD amount will be specified in the tender documentation and is typically refunded upon completion of the tendering process, provided there is no breach of terms.

Bid submissions must occur electronically through the specified portal by the designated end date. It is crucial to adhere to the submission guidelines outlined in the tender documentation. Reminders for important deadlines, including submission and decision-making timelines, will be communicated via official channels.

MSEs and startups have specific advantages in this tender, which may include preferential consideration during the evaluation phase. These provisions aim to promote entrepreneurship and enhance participation from smaller firms that contribute to local economic growth and innovation in financial advisory services. Compliance with guidelines under the ‘Make in India’ initiative may further enhance local procurement opportunities.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders