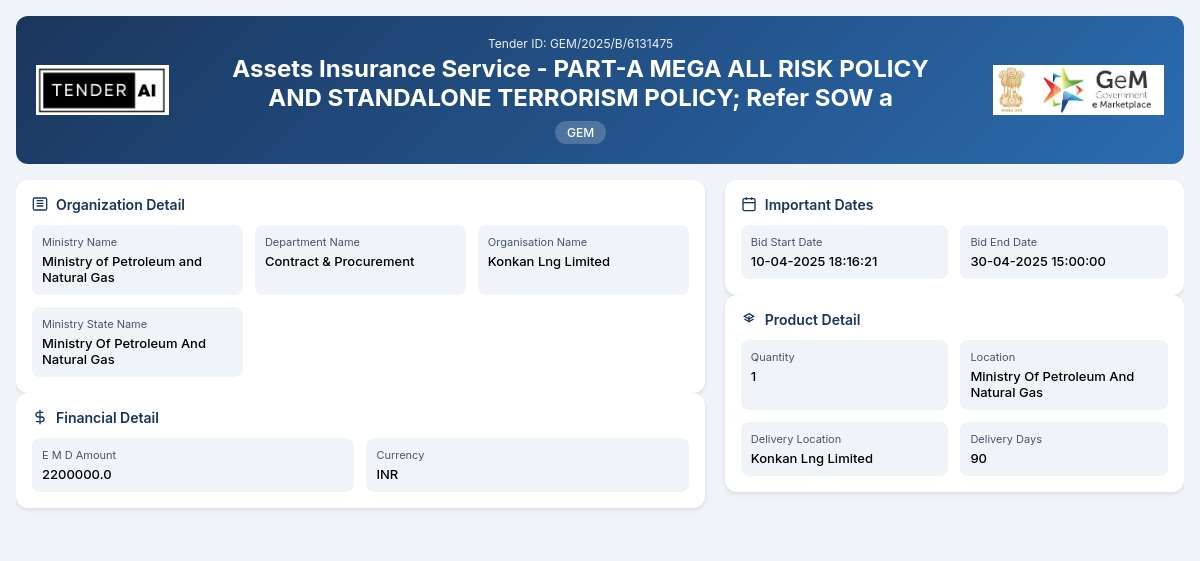

Contract & Procurement Tender by Konkan Lng Limited (GEM/2025/B/6131475)

Assets Insurance Service - PART-A MEGA ALL RISK POLICY AND STANDALONE TERRORISM POLICY; Refer SOW a

Tender Timeline

Title: Assets Insurance Service - PART-A MEGA ALL RISK POLICY AND STANDALONE TERRORISM POLICY

Reference Number: GEM/2025/B/6131475

Issuing Authority: Ministry of Petroleum and Natural Gas, Contract & Procurement Department

The Assets Insurance Service tender aims to procure comprehensive insurance solutions for crucial assets under the jurisdiction of the Ministry of Petroleum and Natural Gas. The scope of this tender encompasses the provision of a Mega All Risk Policy and a Standalone Terrorism Policy, aimed at safeguarding assets from various risks including, but not limited to, fire, transit risks, and terrorism-related events. This opportunity not only seeks to ensure the financial security of assets but also to protect the organizational integrity of the Ministry.

Scope of Work and Objectives

The primary objective of this tender is to establish a robust insurance service that enhances the resilience of significant assets through comprehensive coverage. The tender will be divided into various parts, namely:

- Part A: Mega All Risk Policy and Standalone Terrorism Policy

- Part B: Standard Fire and Special Peril Policy (Declaration)

- Part C: Standard Fire and Special Peril Policy (Open Declaration)

- Part D: Marine and Transit Insurance Service

Each part focuses on delivering tailored insurance solutions aligned with the specific needs of the Ministry.

Eligibility Criteria

Interested bidders must comply with certain eligibility criteria, including the requirement to be a registered entity in accordance with local regulations. Additionally, bidders should possess significant experience in handling insurance services, especially in high-value asset scenarios.

Technical Requirements

Bidders are expected to provide comprehensive technical documents detailing their ability to meet the specified insurance coverage parameters. This includes an outline of the risk management strategies that will be employed to mitigate potential financial losses during the insurance tenure.

Financial Requirements

Participants must demonstrate financial competency by providing financial statements that highlight the stability and viability of their organization. This ensures that the winning bidder can adequately underwrite the comprehensive insurance policies required for high-value assets.

Document Submission Details

Bidders must submit all required documentation electronically, adhering to specified formats which ensure clarity and accessibility. Comprehensive detail regarding document submission methods will be provided upon successful registration on the GEM platform.

Special Provisions

The tender includes provisions for Micro, Small, and Medium Enterprises (MSEs) and startups, encouraging diversity and innovation within the bidding process. Special consideration will be given to these entities as a means to support local businesses.

Evaluation Process

Bids will be evaluated based on a comprehensive assessment framework, encompassing both technical and financial evaluations. Background checks and references may also be required to ascertain the reliability and capability of the bidders.

Delivery Locations

Insurance coverage facilitated through this tender will primarily address assets located within designated operational territories managed by the Ministry of Petroleum and Natural Gas across multiple locations.

Contact Information

For any inquiries related to this tender, stakeholders are encouraged to reach out through the proper channels provided within the GEM platform. Detailed contact information will be made available there.

In summary, the Assets Insurance Service tender presents a valuable opportunity for insurers specializing in high-level asset protection, drive dynamic competition, and facilitate the ongoing operational integrity of critical stakeholders within the petroleum and natural gas sector.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

6 DocumentsDocuments Required from Seller

- Experience Criteria

- Bidder Turnover

- Certificate (Requested in ATC)

- Additional Doc 1 (Requested in ATC)

- Additional Doc 2 (Requested in ATC)

- Additional Doc 3 (Requested in ATC)

- Additional Doc 4 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Corrigendum Updates

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity and possessing relevant experience in insurance services, particularly for high-value assets. Bidders must also demonstrate compliance with local regulations regarding insurance operations and prove their financial stability.

Bidders are required to provide relevant certificates that validate their registration and operational capabilities. These typically include business registration certificates, tax compliance documents, and any additional industry-specific certifications relevant to insurance services.

The registration process involves creating an account on the GEM platform. Once registered, bidders are required to fill out the tender application form and upload the necessary documents as specified in the tender documentation.

Bidders must adhere to prescribed document formats which primarily include PDF or other electronic formats ensuring that all information is legible and easily accessible. Specific requirements will be outlined in the tender document.

The payment terms for the insurance policies will be defined upon final selection of the service provider, typically outlining conditions related to upfront payments, premium structures, and timelines for premium settlement based on policy initiation.

By harmonizing the detailed aspects of the tender with the needs and stipulations, all stakeholders are ensured clarity and guidance throughout the evaluation and submission process.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders