Hydro Power Tender by North Eastern Electric Power Corporation Limited (GEM/2025/B/6159032)

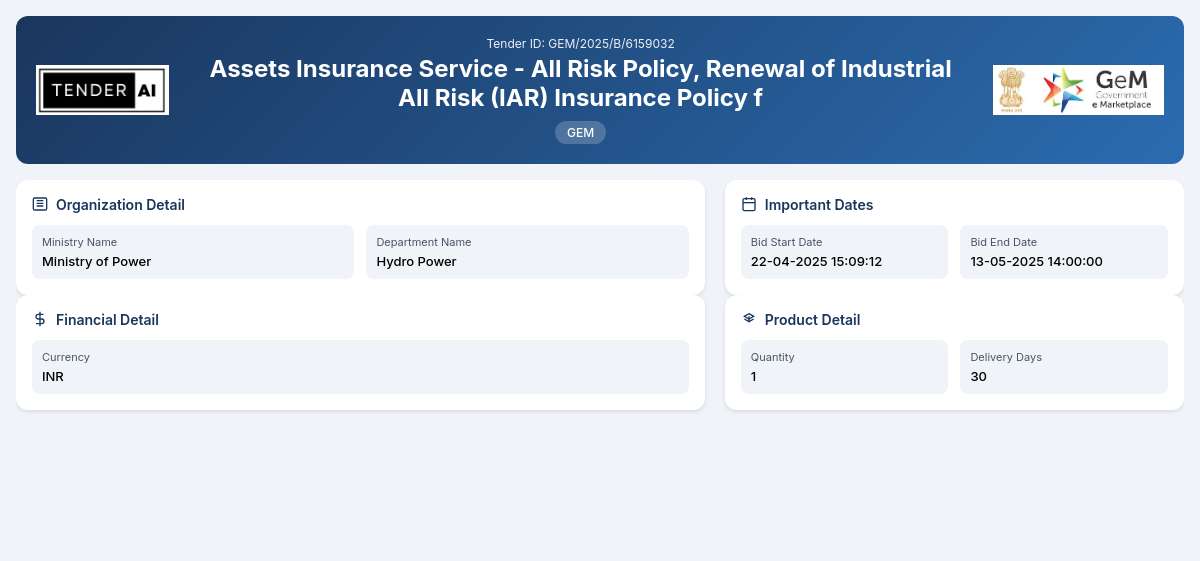

Assets Insurance Service - All Risk Policy, Renewal of Industrial All Risk (IAR) Insurance Policy f

Tender Timeline

Tender Title: Assets Insurance Service - All Risk Policy, Renewal of Industrial All Risk (IAR) Insurance Policy

Tender Reference Number: GEM/2025/B/6159032

Issuing Authority: Ministry of Power, Hydro Power Department

The Ministry of Power is inviting bids for the provision of an Assets Insurance Service - All Risk Policy, specifically focused on the renewal of the Industrial All Risk (IAR) Insurance Policy for the assets of Khandong Stage-II Power Station 23 MW located in Umrongso, Assam. The objective of this tender is to ensure that the assets are adequately covered against various risks for a period of one year.

Scope of Work and Objectives

The scope of work involves the comprehensive coverage of assets under an All Risk Insurance Policy that addresses any potential damages or losses experienced by the Khandong Stage-II Power Station. This insurance will encompass the following key components:

- Coverage of machinery, equipment, and other assets essential to the operation of the power station.

- Protection against loss, theft, fire, and other unforeseen risks.

- Commitment to provide prompt response and resolution services in case of any claims.

The objective is to safeguard the financial interests of the Ministry of Power and ensure the seamless operation of essential services at the power station.

Eligibility Criteria

To be eligible for this tender, bidders must meet the following criteria:

- Must be a registered insurance service provider.

- Proven experience in providing industrial insurance solutions.

- Compliance with all regulatory requirements set forth by the insurance regulatory authority in India.

Technical Requirements

Bidders are required to meet the following technical specifications:

- Demonstrable expertise in evaluating risks associated with hydro-power operations.

- Ability to provide coverage for extensive periods without gaps.

- Strong methodologies for claims management and support.

- Competitive premium rates with comprehensive coverage terms.

Financial Requirements

Bidders must submit their financial proposals, which should include:

- Detailed breakdown of premium rates for the All Risk Insurance Policy.

- Documented financial stability and capability to underwrite the coverage for the assets.

- Any additional fees associated with the implementation of the policy or additional services.

Document Submission Details

Interested bidders should prepare and submit their documents in compliance with the following directives:

- All proposals and necessary documentation must be submitted electronically.

- The submission should include proof of eligibility, technical proposal, and financial bid.

- Any additional documents requested within the tender documentation must also be included.

Special Provisions

Special consideration will be given to Micro, Small, and Medium Enterprises (MSEs) and startups. They are encouraged to participate in this tender to promote growth and inclusivity within the insurance sector.

Evaluation Process

The evaluation of proposals will encompass:

- Technical evaluation based on pre-determined criteria outlined in the tender documents.

- Financial evaluation where the most competitive rates will be regarded.

- A holistic score will determine the final selection, balancing both price and capability.

Delivery Locations

The scope of the insurance will apply to all assets located at the Khandong Stage-II Power Station, situated in the state of Assam.

Contact Information

For any queries related to this tender, potential bidders can contact the Ministry of Power through the designated email or phone number provided in the original document.

The importance of this tender extends beyond mere compliance; it represents a crucial step in ensuring the operational integrity and financial security of one of the vital assets within the power sector.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

5 DocumentsDocuments Required from Seller

- Certificate (Requested in ATC)

- Additional Doc 1 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered and licensed insurance service provider in India, along with having documented experience in providing industrial insurance solutions. Bidders must also comply with the insurance regulatory authority’s guidelines to ensure they are eligible to propose for this All Risk Insurance Policy.

Bidders must present valid certifications that demonstrate their registration as an insurance provider, compliance with industry standards, and operational certification as required by the insurance regulatory authority in India. These certificates are critical to assure stakeholders of the provider’s integrity and capacity to fulfill the insurance obligations.

The registration process for participating in this tender involves applying through the Government E-Marketplace (GEM) platform, where bidders must create an account and complete the registration steps. Once completed, they can access the tender documents, submit proposals electronically, and track their bids as per the guidelines stipulated in the tender.

This tender facilitates special provisions for Micro, Small, and Medium Enterprises (MSEs), including exemptions from certain eligibility criteria and access to a platform that promotes their participation in larger projects. This is aligned with the government’s objective of enhancing the contribution of MSEs to the economy while ensuring compliance with ‘Make in India’ policies and local procurement rules.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders