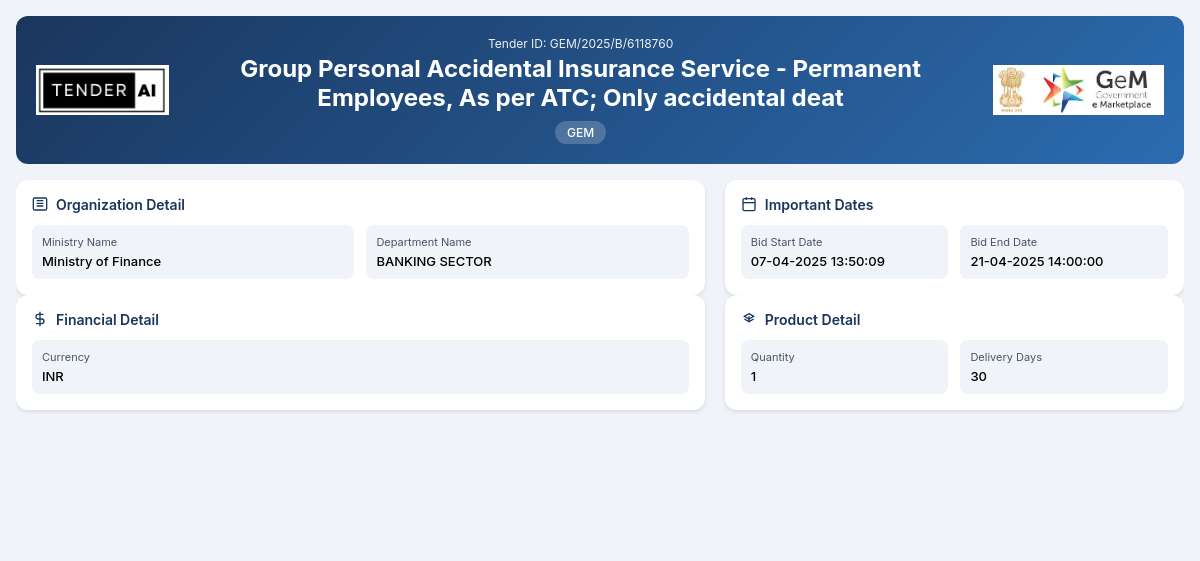

BANKING SECTOR Tenders (GEM/2025/B/6118760)

Group Personal Accidental Insurance Service - Permanent Employees, As per ATC; Only accidental deat

Tender Timeline

Tender Title: Group Personal Accidental Insurance Service for Permanent Employees

Tender Reference Number: GEM/2025/B/6118760

Issuing Authority

The tender is issued by the Ministry of Finance, specifically under the Banking Sector. This tender aims to provide comprehensive insurance coverage to safeguard permanent employees against unforeseen accidents.

Scope of Work and Objectives

The objective of this tender is to solicit proposals for the provision of Group Personal Accidental Insurance Services for permanent employees. The scope encompasses coverage for accidental death, permanent total disability, and permanent partial disability. The services should adhere to existing guidelines under the All India Technical Council (ATC) to ensure stringent compliance and effectiveness in protecting employees.

Eligibility Criteria

To be eligible for submission, bidders must meet the following criteria:

- Be a legally registered insurance provider.

- Possess a valid insurance license.

- Demonstrate prior experience in handling group insurance policies.

- Adhere to governmental norms and standards for insurance provision.

Technical Requirements

The insurance solutions proposed under this tender must comply with specific technical parameters set forth for the scope of work. This includes:

- Comprehensive coverage against accidental scenarios as outlined.

- Adherence to the Quality Standards mandated by the Insurance Regulatory and Development Authority of India (IRDAI).

- Proven methods for implementing effective claims management and customer service support.

Financial Requirements

Bidders must include a financial breakdown in their proposals. The financial evaluation will focus on:

- Competitive premium pricing.

- Sustainable pricing models that align with the tender's objectives.

- Financial stability of the insurance provider, necessitating proof of solvency.

Document Submission Details

Proposals should be submitted electronically through the specified government e-marketplace portal. Bidders must ensure that all documentation is complete and adheres to specified formats. Key documents may include:

- Company registration certificate.

- Insurance license.

- Financial statements.

Special Provisions

This tender provides certain advantages for Micro, Small, and Medium Enterprises (MSEs). Qualified MSEs may enjoy benefits like reduced performance security requirements, which fosters inclusivity in the bidding process. Startups that meet the criteria set forth in the 'Make in India' initiative are also encouraged to apply.

Evaluation Process

The evaluation of proposals will be based on both technical and financial metrics. Technical offerings will be assessed first, with successful applicants moving onto the financial evaluation stage. The final selection will prioritize quality, competitiveness, and compliance.

Delivery Locations

The delivery of insurance services under this tender will be applicable to all locations where permanent employees of the government services are stationed. Bidders should ensure that their services can cover all designated areas effectively.

Contact Information

Should you have any inquiries related to this tender, potential bidders should refer to the official communication channels established by the Ministry of Finance for assistance.

In summary, this tender presents a significant opportunity for insurance providers to participate in a vital service sector aimed at protecting employees against the risks associated with unforeseen accidents. Interested parties are urged to prepare meticulously and submit fulfilling proposals aligned with the outlined requirements.

General Information

Evaluation and Technical Information

Tender Documents

6 DocumentsCorrigendum Updates

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity with a valid insurance license, demonstrating relevant experience in group insurance, and compliance with government standards. Bidders must prove that they can offer group personal accidental insurance services meeting regulatory requirements.

Bidders must submit essential documents such as the company registration certificate, valid insurance license, and recent financial statements. These certificates ensure that the bidding entity is qualified to provide the required Group Personal Accidental Insurance Services and is financially stable.

The registration process involves creating an account on the government e-marketplace portal designated for this tender. Bidders should complete their registration, ensuring that they comply with the documentation requirements stated in the tender details for Group Personal Accidental Insurance Services.

Bidders are required to propose insurance solutions that comply with Industry Quality Standards set by the Insurance Regulatory and Development Authority of India (IRDAI). The proposals should include detailed descriptions of coverage areas, claims management processes, and supporting evidence of compliance with regulatory requirements.

Typically, an Earnest Money Deposit (EMD) is required as part of the tender submission process to ensure seriousness among bidders. Furthermore, a performance security may also be mandated post-award of the contract, the specifics of which must align with the tender regulations. Bidders should prepare to meet these financial obligations as part of their proposals.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders