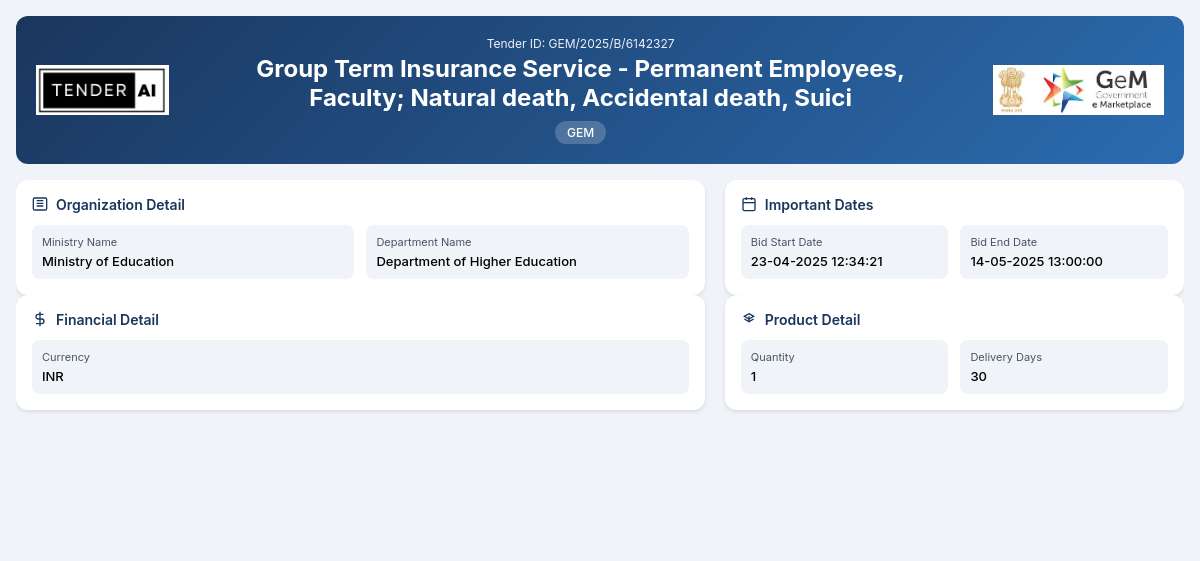

Department of Higher Education Tender by Indian Institute Of Technology (iit) (GEM/2025/B/6142327)

Group Term Insurance Service - Permanent Employees, Faculty; Natural death, Accidental death, Suici

Tender Timeline

Tender Title: Group Term Insurance Service - Permanent Employees, Faculty

Tender Reference Number: GEM/2025/B/6142327

Issuing Authority/Department: Ministry of Education, Department of Higher Education

The Group Term Insurance Service tender focuses on the provision of insurance coverage specifically designed for permanent employees and faculty members within educational institutions. The aim is to ensure financial security through various protection schemes including coverage for natural death, accidental death, suicide, and other unforeseen circumstances that may affect the insured individuals.

Scope of Work and Objectives

The primary objective of this tender is to select a qualified vendor who can provide a comprehensive group term insurance policy that meets the specified requirements. This will include but is not limited to:

- Providing group term insurance coverage to a total of 439 permanent employees and faculty members.

- Ensuring higher protection standards for unfortunate events such as animal bites and pre-existing illnesses as outlined in the policy.

Eligibility Criteria

To participate in this tender, bidders must meet the following eligibility criteria:

- The bidder should be a registered insurance provider capable of offering services tailored to group term insurance.

- Previous experience in administering similar insurance policies for educational or government institutions is advantageous.

- Compliance with local regulations and standards for insurance providers is mandatory.

Technical Requirements

Bidders are expected to provide detailed information regarding the technical specifications of their offerings. This includes:

- Clear delineation of coverage options and limits.

- Policies on claims processing, customer support, and dispute resolution.

- Documented proof of adherence to accepted quality standards.

Financial Requirements

Interested parties must submit detailed financial documents including:

- Recent financial statements demonstrating the company's fiscal stability.

- A breakdown of pricing and payment terms including premiums, fees, and other charges associated with the policy.

- An outline of any additional costs that may be incurred during the policy period.

Document Submission Details

Bidders must ensure that all required documents are submitted in accordance with the guidelines established by the issuing authority. This includes:

- Submission of completed bidding forms.

- Technical and financial proposals should be packaged separately.

- All documents must be submitted in PDF or DOCX format for acceptance.

Special Provisions

This tender encourages participation from Micro, Small, and Medium Enterprises (MSEs) and startups. Provisions have been made to facilitate their involvement in the bid process, recognizing their contributions to the economy and sector innovation.

Evaluation Process

The evaluation of bids will follow a structured approach based on:

- Technical merit and compliance with the scope of services.

- Financial viability and pricing structure.

- Overall experience and reputation in the sector.

Selection will prioritize bidders who showcase exceptional service quality alongside competitive pricing.

Delivery Locations

The insurance services will apply to all permanent employees and faculty located under the purview of the Ministry of Education, with no specific delivery location constraints as the service is inherently virtual and policy-based.

Contact Information

For further inquiries regarding the tender, interested parties may reach out to the Ministry of Education. However, specific contact information will be provided within the official tender documents upon request.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

4 DocumentsDocuments Required from Seller

- Experience Criteria

- Certificate (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered insurance provider capable of offering group term insurance. Potential bidders must demonstrate previous experience in administering similar policies and ensure compliance with local insurance regulations.

Bidders must submit proof of registration with relevant insurance agencies and provide any standard operating procedures or quality assurance certifications. These ensure that the bidding entity conforms to industry standards and practices associated with group term insurance.

The registration process involves filling out the official bidding forms provided in the tender documents. Bidders should ensure that they meet all financial and technical requirements stipulated and submit all necessary documentation by the specified guidelines.

Payment terms generally include detailed specifications regarding premium payments, applicable fees, and any conditions under which additional costs may arise. Bidders need to make sure their proposals include a comprehensive overview of these terms in their financial submission.

Yes, the tender provides special provisions for Micro, Small, and Medium Enterprises (MSEs). These benefits are aimed at encouraging the participation of smaller firms by facilitating access to resources and offering competitive bidding advantages, in alignment with recent governmental policies supporting local businesses.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders