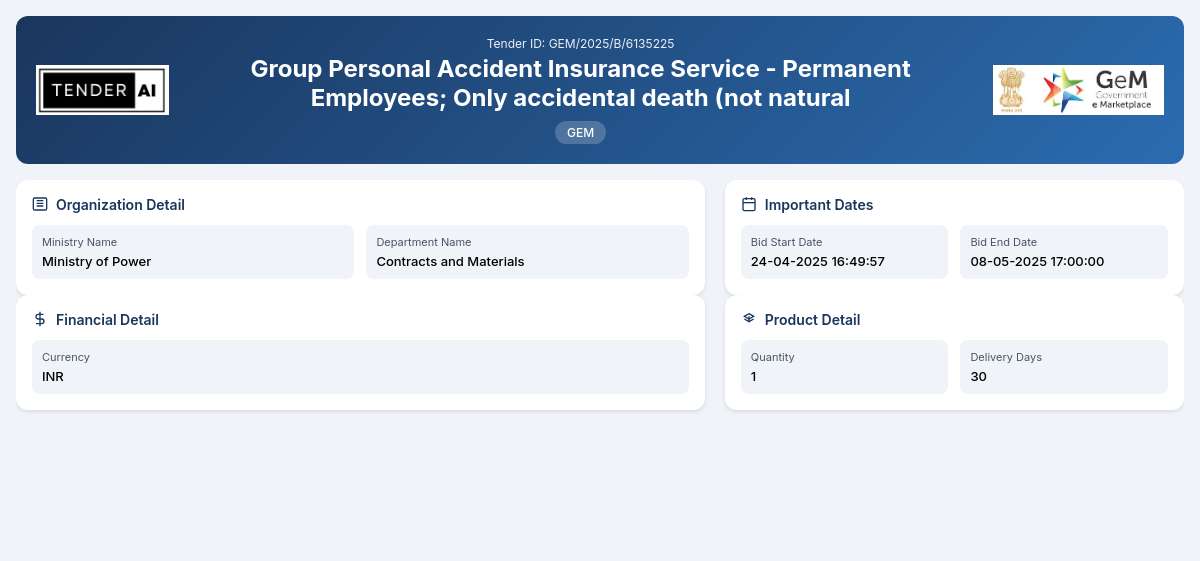

Contracts and Materials Tender by Damodar Valley Corporation (GEM/2025/B/6135225)

Group Personal Accident Insurance Service - Permanent Employees; Only accidental death (not natural

Tender Timeline

Tender Title: Group Personal Accident Insurance Service for Permanent Employees

Reference Number: GEM/2025/B/6135225

Issuing Authority/Department: Ministry of Power, Contracts and Materials

The Group Personal Accident Insurance Service for Permanent Employees tender presents a unique opportunity to provide vital insurance coverage to employees against unforeseen incidents. The tender focuses specifically on accidental death, permanent total disability, permanent partial disability, and temporary disabilities, ensuring comprehensive support for employees in case of accidents. This initiative falls under a broader objective of enhancing employee welfare and promoting a safe work environment.

Scope of Work and Objectives

The primary objective of this tender is to secure reliable insurance services that will cover 4898 permanent employees against various types of accidental risks. The insurance service provider will be responsible for delivering robust plans that clearly define coverage parameters, claim processes, and additional support services. The awarded service is pivotal to guaranteeing employee security, satisfaction, and organizational accountability.

Eligibility Criteria

To qualify for participation in this tender, bidders must meet the following criteria:

- Must be a duly registered insurance provider recognized under relevant laws.

- Prior experience in providing group personal accident insurance services.

- The ability to demonstrate financial stability and adequate support infrastructure.

Technical Requirements

Bidders must furnish detailed technical proposals that include:

- Comprehensive coverage details, outlining specific terms for accidental death and various disability classifications.

- Evidence of the company’s financial capability, including past performance records in similar projects.

- Mechanisms for swift claims processing and customer support facilities.

Financial Requirements

Potential bidders are required to provide financial documents showcasing their ability to sustain the insurance schemes on offer. This includes:

- Recent financial statements.

- Cost estimates for the proposed insurance coverage, detailing premium amounts.

Document Submission Details

All proposals must be submitted electronically through the designated platform, including necessary supporting documents in acceptable formats (PDF and DOCX). Bidders are advised to pay careful attention to ensure completeness, as any missing documentation may lead to disqualification.

Special Provisions

This tender also encourages participation from Micro, Small, and Medium Enterprises (MSEs) and start-ups. Bids submitted by these entities, if compliant with eligibility criteria, may avail themselves of specific benefits designed to foster inclusion and support local businesses.

Evaluation Process

Proposals will undergo a comprehensive evaluation based on the following criteria:

- Compliance with eligibility and technical requirements.

- Financial viability and competitive pricing.

- Overall quality of the proposal including service delivery timelines.

The selection process ensures a fair assessment tailored towards finding a provider that not only meets the cost expectation but also brings quality and reliability to the services rendered.

Delivery Locations

The insurance service must cater to all employees registered under the Ministry of Power and will potentially cover various work locations dictated by the organization’s operational reach.

Contact Information

For additional inquiries or clarification, bidders are encouraged to reach out directly to the relevant departments involved in this tender. Contact details can be accessed through the official Ministry of Power communications channels.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

7 DocumentsDocuments Required from Seller

- Bidder Turnover

- Certificate (Requested in ATC)

- Additional Doc 1 (Requested in ATC)

- Additional Doc 2 (Requested in ATC)

- Additional Doc 3 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered insurance provider, possessing a proven track record in group personal accident insurance services, and demonstrating financial stability as evidenced by adequate documentation. Bidders must also comply with local laws governing insurance services.

Bidders need to submit registration certificates confirming legal compliance to operate as an insurance provider, along with technical accreditation documents that validate their capability to undertake the proposed services. Relevant financial statements are also essential.

The registration process involves completing the bid submission on the designated electronic platform. Bidders must provide all required documents, including eligibility and technical proposals, to ensure full compliance with the tender specifications.

Selected bidders may be required to furnish a performance security deposit, typically a percentage of the total contract value, which guarantees the commitment to uphold the terms of the contract. Exact details will be specified upon contract awarding.

Yes, the tender includes special provisions aimed at benefiting Micro, Small, and Medium Enterprises (MSEs) and startups. These provisions may include priority in evaluation and potential financial support mechanisms to encourage participation from local businesses and promote adherence to ‘Make in India’ policies.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders