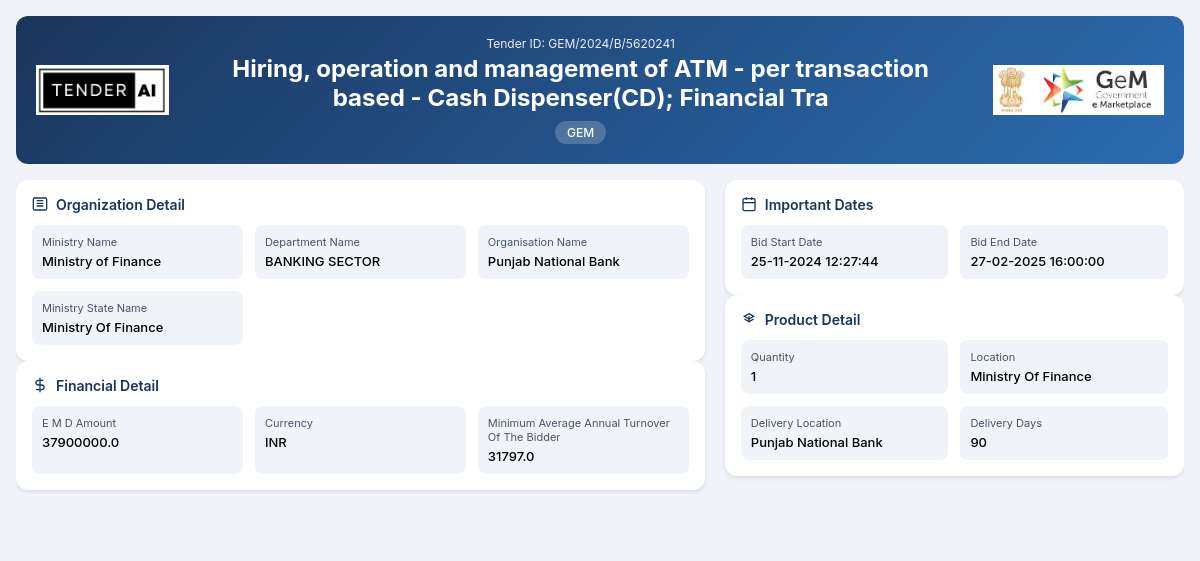

BANKING SECTOR Tender by Punjab National Bank (GEM/2024/B/5620241)

Hiring, operation and management of ATM - per transaction based - Cash Dispenser(CD); Financial Tra

Tender Timeline

Tender Title: Hiring, Operation, and Management of ATM - Per Transaction Based - Cash Dispenser (CD); Financial Transactions

Tender Reference Number: GEM/2024/B/5620241

Issuing Authority: Ministry of Finance, Banking Sector

Overview

The purpose of this tender is to engage a competent service provider for the hiring, operation, and management of Automated Teller Machines (ATMs). This encompasses both financial transactions and non-financial transactions, aimed at supporting the provision of cash dispensation services effectively across multiple locations.

Scope of Work and Objectives

The scope of work includes the management of up to 200 ATMs categorized as follows:

- Financial Transactions for both onsite and offsite ATMs.

- Non-Financial Transactions for both onsite and offsite ATMs.

The objective of this tender is to ensure uninterrupted access to cash for customers, enhance the operational efficiency of ATMs, and provide reliable customer service at all locations.

Eligibility Criteria

To qualify for this tender, bidders must meet the following criteria:

- Must be a registered entity with a valid business license.

- A proven track record of at least 3 years of experience in the ATM operation and management sector.

- Present average annual turnover of at least 31.797 Crores over the last three fiscal years.

Technical Requirements

Bidders must comply with technical stipulations related to the operation and management of ATMs which include:

- Complete integration of ATMs with central banking systems.

- Adherence to industry-standard security protocols.

- Provision of technical support and maintenance services.

Financial Requirements

- An Earnest Money Deposit (EMD) of 37.9 million is mandatory to be submitted with the bid.

- A demonstrated financial capacity to meet the operational demands projected in the tender.

Document Submission Details

Bidders are required to submit all necessary documentation as specified, including:

- Experience certificates

- Financial statements demonstrating the required turnover

- Additional documents as requested in the Additional Terms and Conditions (ATC)

For comprehensive documentation, bidders can refer to the official documents linked here.

Special Provisions

This tender encourages participation from Micro, Small, and Medium Enterprises (MSEs) and startups, providing benefits such as:

- Relaxation in experience requirements.

- Opportunities for limited-scale operations to contribute to the national economy.

Evaluation Process

The bids will be evaluated based on the total value wise evaluation method. Key considerations will include:

- Completeness of the proposal.

- Financial and technical capabilities.

- Compliance with the stipulated criteria.

Delivery Locations

Services under this tender will be required across various locations as specified by the Ministry of Finance during the bid evaluation process. Bidders should prepare for a diverse operational environment.

Contact Information

For queries regarding the tender, bidders are encouraged to refer to the official documentation or utilize the resources provided in the link.

In summary, this tender represents an opportunity for qualified entities in the ATM management space to contribute significantly to the banking sector while adhering to the laid down requirements and standards.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

6 DocumentsDocuments Required from Seller

- Experience Criteria

- Bidder Turnover

- Additional Doc 1 (Requested in ATC)

- Additional Doc 2 (Requested in ATC)

- Additional Doc 3 (Requested in ATC)

- Additional Doc 4 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Corrigendum Updates

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity with a valid business license, possessing 3 years of past experience in ATM operation and management, and demonstrating an average annual turnover of 31.797 Crores over the last three years.

Bidders must possess relevant certifications that prove their operational capabilities and compliance with regulatory standards in the banking sector, alongside financial statements as part of the submission.

To register for participation, bidders must complete the registration process through the official platform where the tender is hosted. Registration typically involves providing requisite company details and documentation.

Accepted document formats are typically PDF or other universally readable formats. Bidders should ensure that all documents are complete and legible to avoid disqualification.

Bidders must demonstrate the ability to integrate ATMs with centralized banking systems, ensure security compliance, and offer complete maintenance and support for operational continuity.

Bidders must adhere to the highest quality standards set forth in the banking sector, ensuring that all ATMs are secure, functional, and user-friendly.

Yes, compliance requirements include adherence to the relevant banking regulations, security protocols, and operational guidelines laid out by the Ministry of Finance.

Testing criteria usually include validations of technical specifications, operational capacity assessments, and security compliance checks before the contract award.

The Earnest Money Deposit (EMD) required for this tender is 37.9 million, which must be submitted alongside the bid to ensure serious consideration.

Successful bidders may be required to submit a performance security guarantee as specified in the tender documentation to secure contract fulfillment.

Detailed payment terms will be outlined in the awarded contract, typically based on the successful delivery of services or milestones achieved.

Price evaluation will be carried out based on the overall financial proposal’s viability and value-for-money assessment, alongside technical compliance.

Bids must be submitted electronically through the tendering portal, following the guidelines set out in the tender documentation.

While specific dates are subject to change, bidders should pay attention to submission deadlines and evaluation periods as highlighted in the tender documents.

The evaluation process includes a technical assessment followed by a financial review. Bids are shortlisted based on compliance with eligibility and quality standards.

Post-evaluation, qualified bidders will receive an official notification through the tender platform or via email, confirming their selection status and any further steps required.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders