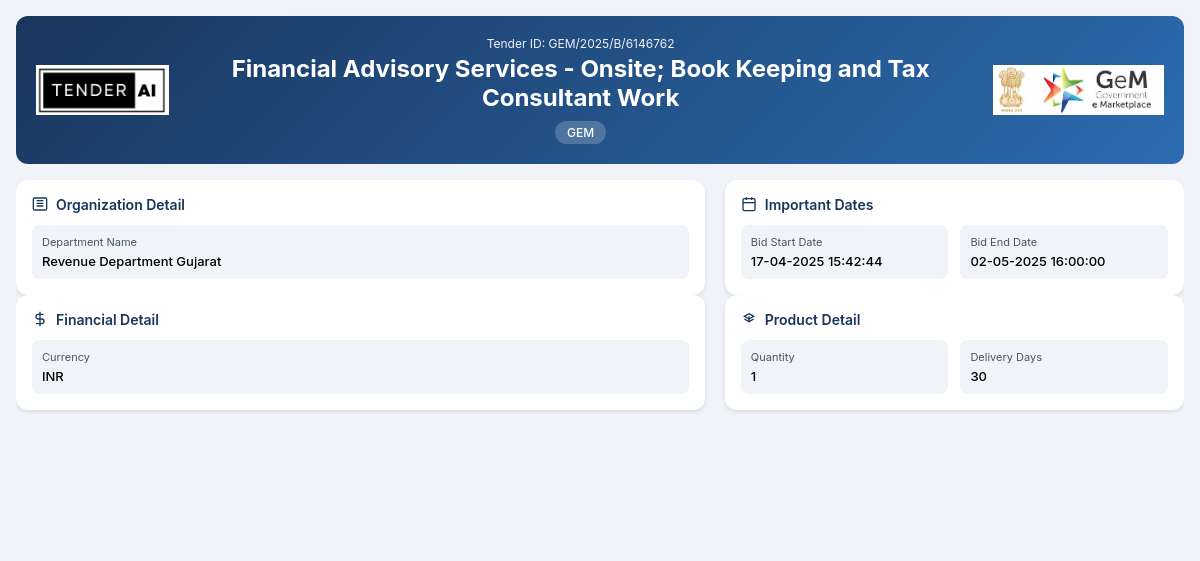

Revenue Department Gujarat Tenders (GEM/2025/B/6146762)

Financial Advisory Services - Onsite; Book Keeping and Tax Consultant Work

Tender Timeline

Tender Title: Financial Advisory Services - Onsite; Book Keeping and Tax Consultant Work

Tender Reference Number: GEM/2025/B/6146762

Issuing Authority/Department: Revenue Department Gujarat

The Financial Advisory Services - Onsite; Book Keeping and Tax Consultant Work tender aims to engage expert firms or consultants who can provide comprehensive financial advisory services to the Revenue Department of Gujarat. The scope of this tender includes offering professional advisory support in areas such as bookkeeping, tax consultancy, compliance with regulatory requirements, and creating financial reporting systems that enhance operational efficiency.

Scope of Work and Objectives

The main objectives of this tender are to:

- Deliver accurate and timely financial advice to assist the Revenue Department in its decision-making processes.

- Ensure thorough bookkeeping services that comply with relevant laws and standards.

- Facilitate tax consultancy services, helping the department navigate complex tax regulations and ensuring compliance.

- Establish reliable financial reporting systems that align with best practices.

Eligibility Criteria

To qualify for participation in this tender, bidders must meet the following eligibility requirements:

- Registration as a legal entity with appropriate licensure in financial consultancy.

- A proven track record in providing similar services to government departments or large organizations.

- Technical and financial capacities should be demonstrable through previous work experience.

Technical Requirements

Bidders must present their technical credentials that include:

- Detailed methodologies for providing bookkeeping and tax consultancy services.

- Profiles of key personnel involved in service delivery, including their qualifications and experience.

- Compliance with local regulations and industry standards, including IT security standards where applicable.

Financial Requirements

Submissions must include:

- A comprehensive budget outlining the cost structure for the services proposed.

- Proof of financial stability via recent audited financial statements.

- Details of any required Earnest Money Deposit (EMD) which may need to be submitted along with proposals.

Document Submission Details

Interested bidders are required to submit their proposals electronically through the designated portal. All documents should be prepared in accordance with the submission guidelines outlined in the tender.

Special Provisions

In recognition of the role of Micro, Small, and Medium Enterprises (MSEs) in the economy, special considerations may be extended to MSEs participating in this tender. Furthermore, provisions favoring startups, in line with government policies, may also apply.

Evaluation Process

The evaluation of submitted bids will consider both technical competencies and financial proposals. The criteria will include:

- Completeness of documentation and adherence to submission guidelines.

- Robustness of the proposed methodology and qualifications of the project team.

- Cost-effectiveness and clarity of the pricing structures.

Delivery Locations

Services are required to be delivered at various locations as designated by the Revenue Department of Gujarat, with specifics communicated upon commencement of the contract.

Contact Information

For questions or clarifications regarding this tender, bidders may use the contact information provided in the tender notices. It is advisable to refer to the official portal for any updates or announcements.

In conclusion, the GEM/2025/B/6146762 tender presents a significant opportunity for qualified firms to partner with the Revenue Department of Gujarat in enhancing its financial operations through professional advisory services.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

3 DocumentsDocuments Required from Seller

- Experience Criteria

- Certificate (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity, and qualified to provide financial advisory services. Bidders should have relevant experience in handling projects of similar nature, particularly involving government clients. Additionally, they must meet any specific regulatory standards applicable to financial advisory services.

Bidders must demonstrate compliance with industry standards in their technical specifications. This entails detailed methodologies showcasing their approach to bookkeeping and tax consultancy, credentials of their experts, and adherence to local regulations. Compliance with quality standards and best practices is essential for evaluating the proposals.

The submission process for this tender is through an electronic portal, where bidders can upload their proposals. Accepted document formats typically include PDF and Word formats. All documents should be legible and organized as per the submission guidelines to ensure smooth processing of proposals.

Bidders will need to provide details on performance security requirements upon winning the tender. This may involve a bank guarantee or another form of security to ensure compliance with contractual obligations. Details will be clearly outlined in the final contract documentation if awarded the tender.

Yes, the tender acknowledges the importance of Micro, Small, and Medium Enterprises (MSEs). There are provisions that favor the participation of MSEs, aiming to provide them with competitive opportunities while contributing to their growth in the sector. Participation also aligns with programs such as ‘Make in India,’ encouraging local procurement practices.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders