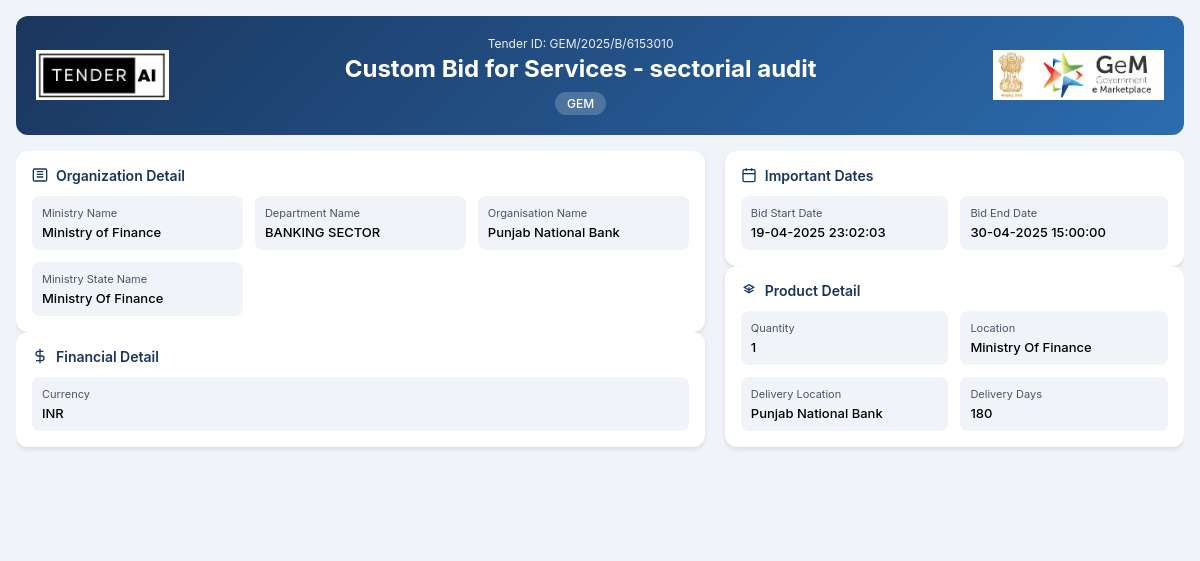

BANKING SECTOR Tender by Punjab National Bank (GEM/2025/B/6153010)

Custom Bid for Services - sectorial audit

Tender Timeline

Tender Title: Custom Bid for Services - Sectorial Audit

Reference Number: GEM/2025/B/6153010

Issuing Authority: Ministry of Finance, Banking Sector

The Custom Bid for Services - Sectorial Audit is initiated by the Ministry of Finance, under the auspices of the Banking Sector. This tender aims to engage qualified entities to conduct a comprehensive sectorial audit within the banking domain, assessing compliance, efficiency, and effectiveness of current operational methodologies. The auditing process will facilitate the identification of opportunities for improvement, ensuring tighter controls, risk management, and alignment with national financial regulations.

Scope of Work and Objectives

The successful bidder will be expected to carry out a thorough sectorial audit that encompasses:

- Assessing the internal controls and operational efficiency.

- Evaluating compliance with relevant laws and regulations.

- Providing actionable insights based on quantitative and qualitative data.

- Preparing detailed audit reports encompassing key findings and recommendations.

Eligibility Criteria

To qualify for this tender, bidders must possess:

- Registration as a legal entity in India.

- Proven experience in conducting financial audits with evidenced documentation.

- Adequate manpower and resources to effectively complete the audit scope delineated in the tender.

Technical Requirements

Bidders should demonstrate compliance with the following technical standards:

- Familiarity with legislative frameworks governing the banking sector.

- Expertise in audit methodologies and risk assessment practices.

- Capability to deliver reports in accepted formats (PDF, Word).

Financial Requirements

Bidders should be prepared to furnish:

- Evidence of financial stability, such as bank statements or financial records.

- A commitment to adhere to the pricing structure stipulated within the tender framework.

Document Submission Details

All bid documents must be submitted electronically via the designated electronic procurement platform. Bidders are required to ensure:

- All documentation is uploaded in the accepted formats.

- Compliance with submission guidelines to ensure bid validity.

Special Provisions

Encouraging inclusivity, the tender outlines benefits for Micro, Small, and Medium Enterprises (MSEs). Such entities are encouraged to participate under the provisions that aim for fair competition and equal opportunity in accessing government contracts. Startups will also be given consideration as part of this initiative to boost innovation within the sector.

Evaluation Process

The evaluation will be based on both technical and financial submissions, ensuring a holistic approach to selection. Bids will be scrutinized for:

- Compliance with eligibility and technical requirements.

- Value for money and cost-effectiveness in financial proposals.

Delivery Locations

The audits will primarily take place in the regions specified by the Ministry of Finance, as part of its operational jurisdiction within the banking sector.

Contact Information

For further queries and clarifications regarding the bid, interested parties are encouraged to reach out through the official communication channels of the Ministry.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

8 DocumentsDocuments Required from Seller

- Certificate (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements for this tender include that bidders must be registered entities in India. They should also demonstrate prior experience in conducting financial audits, backed by valid documentation. Adequate resources and skilled personnel to execute the sectorial audit are mandatory to qualify for this tender.

Bidders must comply with several technical specifications, encompassing familiarity with the legislative frameworks applicable to the banking industry. They must also display a sound understanding of audit methodologies and exhibit their ability to furnish comprehensive reports in acceptable formats like PDF and Word.

Yes, bidders may be required to submit a performance security to ensure the fulfillment of contractual obligations once selections are made. Details regarding the amount and procedure for the security deposit will be communicated as part of the final bidding process.

Submission of bid documents must occur electronically through the designated procurement portal. Bidders are required to ensure that all documents adhere to the prescribed submission guidelines to maintain the validity of their bids.

The tender includes special benefits for Micro, Small, and Medium Enterprises (MSEs) to foster competition within the government procurement landscape. Additionally, provisions for startups are integrated, encouraging innovative solutions and greater participation in government contracts, thus supporting the ‘Make in India’ initiative.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders