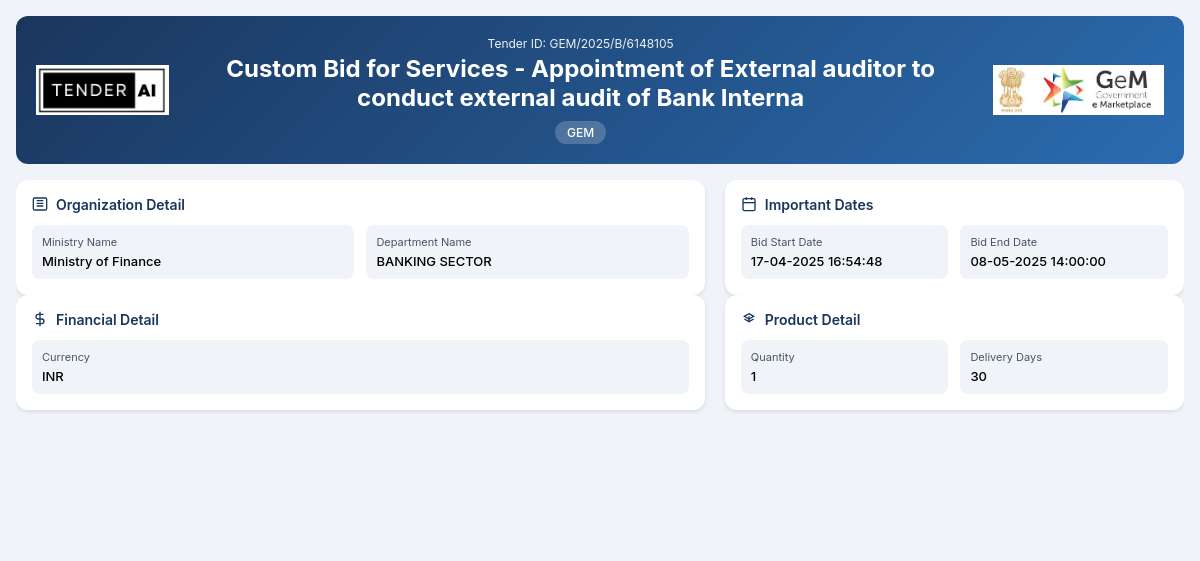

BANKING SECTOR Tender by Punjab National Bank (GEM/2025/B/6148105)

Custom Bid for Services - Appointment of External auditor to conduct external audit of Bank Interna

Tender Timeline

Tender Title: Appointment of External Auditor for Conducting External Audit of Bank Internal Audit System

Reference Number: GEM/2025/B/6148105

Issuing Authority/Department:

Ministry of Finance, Banking Sector

Scope of Work and Objectives

The objective of this tender is to engage an external auditor who will conduct a thorough external audit of the Bank Internal Audit System. The selected auditing firm will be responsible for evaluating the effectiveness and compliance of the internal audit practices, assessing risk management processes, and providing a comprehensive report with actionable recommendations. This engagement aims to enhance the overall governance and operational efficiency of the banking sector.

Eligibility Criteria

To be considered for this tender, bidders must meet the following eligibility criteria:

- Be a registered entity with a legal presence in the country.

- Have relevant experience in conducting external audits for banking or financial institutions.

- Possess a valid license to operate as an audit firm.

- Demonstrate compliance with local laws and regulations.

Technical Requirements

Bidders are required to submit documents demonstrating their technical capabilities, which should include:

- Details of previous relevant audit projects.

- Profiles of key personnel who will be involved in the audit.

- Any certifications that validate the firm’s expertise in auditing and finance.

Financial Requirements

The proposal must outline the financial aspects, including:

- A detailed breakdown of costs associated with the audit.

- Payment terms and conditions.

- Information on any additional fees that may incur during the audit process.

Document Submission Details

All bids must be submitted in the prescribed format, which includes:

- Technical proposal.

- Financial proposal.

- Any required supporting documents. Bids should be electronically submitted through the official government portal by the defined deadline.

Special Provisions

This tender encourages participation from Micro, Small, and Medium Enterprises (MSEs) and offers special provisions for startups. This includes:

- Reduced bid security requirements.

- Technical assistance and mentorship programs for new entrants in the auditing sector.

Evaluation Process

The evaluation of bids will be conducted based on the following criteria:

- Technical competency and relevant experience.

- Financial proposal and value for money.

- Compliance with the submission requirements.

The awarding authority will communicate its decision to the shortlisted bidders.

Delivery Locations

The appointed external auditor will be required to conduct audits at various branch locations of the banking institution as specified in the project guidelines.

Contact Information

For any inquiries regarding this tender, bidders may reach out through the official channels provided in the tender document. It is advised to communicate via emails or designated contact numbers available on the tender portal for accurate and prompt responses.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

8 DocumentsDocuments Required from Seller

- Experience Criteria

- Bidder Turnover

- Additional Doc 1 (Requested in ATC)

- Additional Doc 2 (Requested in ATC)

- Additional Doc 3 (Requested in ATC)

- Additional Doc 4 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity with a legal presence in the country, possessing relevant experience in conducting external audits particularly in the banking sector, and having a valid license to operate as an audit firm. Bidders must also ensure compliance with all applicable local laws and regulations. Additional documentation verifying past audit projects and qualifications of staff may be necessary to demonstrate fitness for the task.

Bidders are required to provide detailed documentation concerning their technical specifications. This encompasses evidence of prior relevant audit projects, qualifications of key personnel, and supporting certifications that highlight the firm’s expertise in conducting banking audits. Additional technical details regarding audit methodologies and tools employed should also be included in the proposal.

The financial requirements for submission dictate that bidders provide a comprehensive breakdown of costs related to the external audit, outlining all fees, payment terms, and any additional charges that may arise during the audit process. All financial details must be clear and itemized to enable proper evaluation and ensure transparency in pricing.

All bids must be submitted electronically through the designated government procurement portal. The submission must consist of distinct technical and financial proposals, along with all requisite supporting documents. Bidders are advised to ensure their submissions meet all specified formatting requirements and are completed before the deadline for consideration.

The tender includes special provisions for Micro, Small, and Medium Enterprises (MSEs). Such benefits may include reduced requirements for bid security, technical assistance programs, and mentorship opportunities geared towards fostering competition and inclusivity within the auditing sector. By encouraging MSE participation, the tender aims to promote a diverse and vibrant bidding environment, enhancing opportunities for emerging businesses.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders