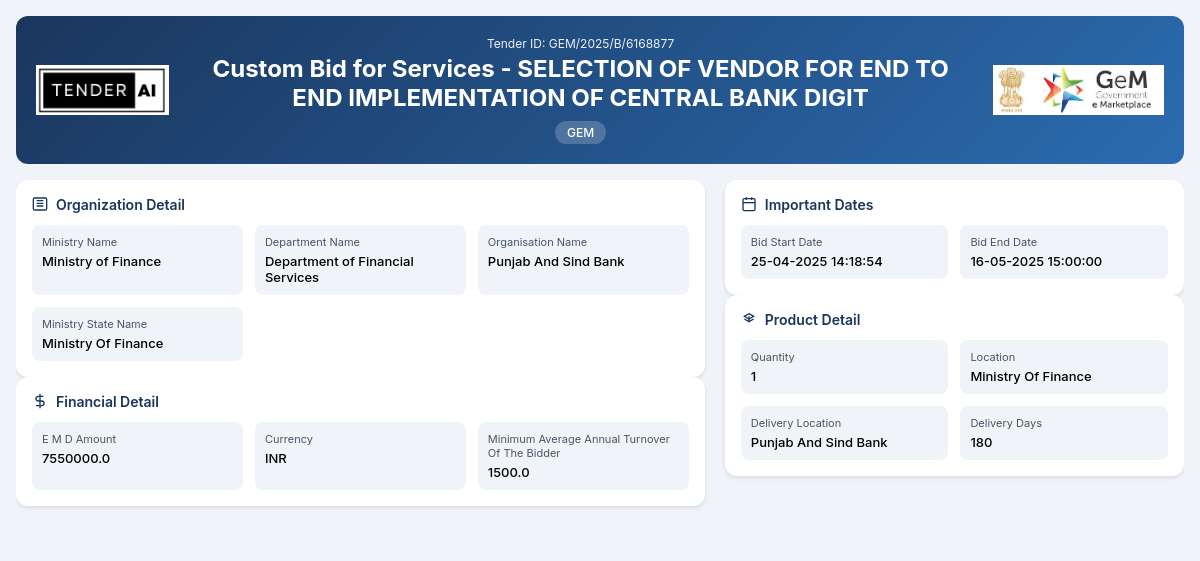

The GEM/2025/B/6168877 tender, titled "Selection of Vendor for End-to-End Implementation of Central Bank Digital Currency (Retail & Wholesale)", is issued by the Department of Financial Services, under the Ministry of Finance. This tender represents an opportunity for qualified vendors to provide a comprehensive solution for the implementation of a Central Bank Digital Currency (CBDC).

Scope of Work and Objectives

The primary objective of this tender is to select a vendor who will facilitate the end-to-end implementation of a Central Bank Digital Currency (CBDC). The scope encompasses all critical components required for the successful development, deployment, and management of the digital currency system, including but not limited to:

- Design and architecture of the CBDC infrastructure

- Development of software solutions

- Integration with existing banking systems

- Compliance with regulatory requirements

- Security measures and risk management

This initiative is aimed at promoting efficient digital transactions within both retail and wholesale sectors, enhancing financial inclusion and fostering the development of innovative payment solutions.

Eligibility Criteria

Eligibility for participation in this tender is open to firms that meet the following criteria:

- Must be a registered entity in compliance with applicable laws.

- Demonstrated experience in implementing similar financial technologies.

- Financial stability, and assurance of capability to perform the contract.

- Proven track record of working with government or regulatory bodies in the financial sector.

Technical Requirements

Vendors need to comply with specific technical requirements including:

- Previous experience in digital currency systems or related technologies.

- Capacity to adhere to security protocols and best practices in financial technology.

- Ability to deliver a fully functional system within stipulated timeframes and budgets.

Financial Requirements

Vendors are expected to provide a detailed financial proposal that includes:

- Pricing models for all phases of the project.

- Projections of operational costs over time.

- Payment milestones aligned with key deliverables.

Document Submission Details

Interested vendors must submit the following documents:

- Company profile and registration certificates.

- Technical proposal detailing how the requirements will be met.

- Financial proposal in the specified format.

- Any additional proof of experience as requested in the tender documents.

Special Provisions

This tender may include provisions for Micro, Small, and Medium Enterprises (MSEs) and startups to encourage their participation. This includes technical support, financial aids, or exemptions to ensure fair competition.

Evaluation Process

Vendors will be evaluated based on criteria including:

- Completeness and quality of technical proposals.

- Financial viability.

- Compliance with eligibility and technical requirements.

Evaluation will aim to select a vendor that offers the best value for money while adhering to all specifications.

Delivery Locations

The delivery and operational implementation of the CBDC system will primarily take place within the jurisdiction of the Ministry of Finance and applicable state banks facilitated by the Department of Financial Services.

Contact Information

For updates or clarifications regarding the tender, vendors are encouraged to reach out to the Department of Financial Services directly through their official communication channels.

This tender is a significant step toward modernizing payment systems and enhancing the efficiency of financial transactions across the country. Vendors equipped with the required capabilities are encouraged to submit their bids and participate in this transformative project.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

19 DocumentsDocuments Required from Seller

- Experience Criteria

- Bidder Turnover

- Certificate (Requested in ATC)

- OEM Authorization Certificate

- OEM Annual Turnover

- Additional Doc 1 (Requested in ATC)

- Additional Doc 2 (Requested in ATC)

- Additional Doc 3 (Requested in ATC)

- Additional Doc 4 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity, having proven experience in implementing financial technologies similar to Central Bank Digital Currency, and possessing financial stability to ensure successful project execution. Furthermore, vendors should provide evidence of compliance with regulatory standards and a background of working with government bodies in the financial sector.

To participate, vendors must submit various required certificates, including company registration, tax compliance, and any relevant industry certifications that validate their capability to deliver on the project. Certificates demonstrating past project success and compliance with security standards in technology implementations are also essential.

The registration process involves submitting a complete bid proposal that includes technical and financial documents, as outlined in the tender documentation. Vendors must register on the official procurement platform and ensure their profiles are updated to participate in this tender successfully.

Accepted document formats vary but typically include PDF and Excel formats for financial proposals, along with Word documents for any narratives or technical description. Vendors should ensure that all submissions adhere to the stated format requirements in the tender guidelines to avoid disqualification.

Micro, Small, and Medium Enterprises (MSEs) may benefit from provisions like technical assistance, financial incentives, and potential exemptions that foster fair competition. Furthermore, their participation supports inclusivity in significant governmental projects, falls under the ‘Make in India’ initiative, and can lead to expanded business opportunities in the financial technology space.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders