Tender Timeline

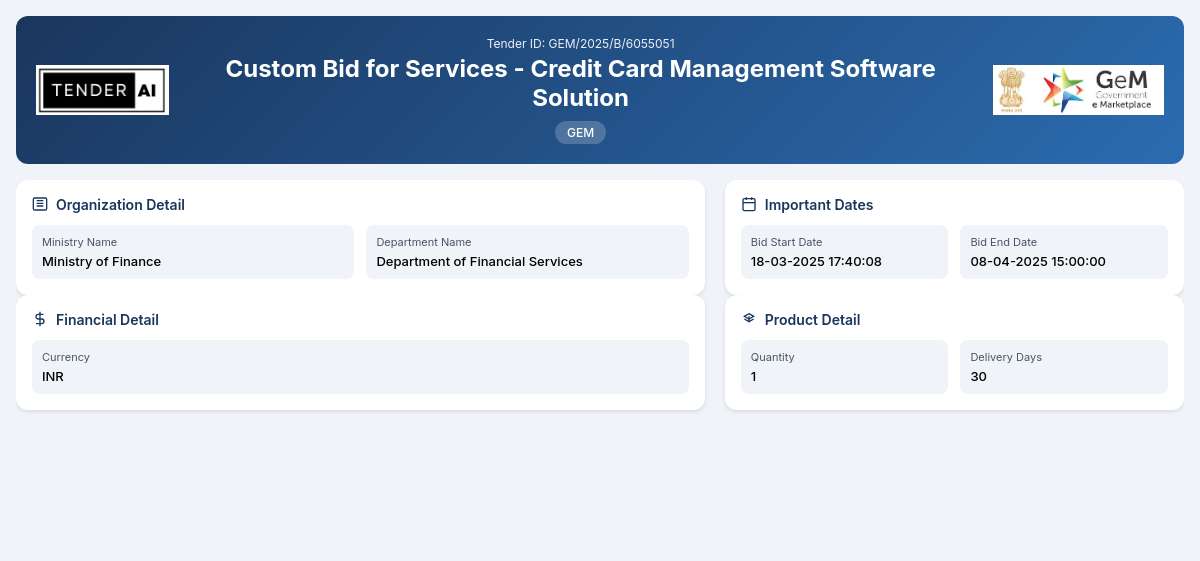

Tender Title: Custom Bid for Services - Credit Card Management Software Solution

Reference Number: GEM/2025/B/6055051

Issuing Authority/Department: Department of Financial Services, Ministry of Finance

The Custom Bid for Services - Credit Card Management Software Solution is a strategic initiative aimed at enhancing the financial transaction capabilities for various stakeholders involved in the credit card management ecosystem. This tender is focused on procuring a comprehensive software solution that streamlines processes associated with credit card management and ensures alignment with regulatory standards.

Scope of Work and Objectives

The primary objective of this tender is to implement a robust credit card management software solution that offers a wide range of functionalities including transaction processing, fraud detection, customer analytics, reporting capabilities, and compliance management. The software must be adaptable to the unique needs of various financial institutions, enabling seamless integration with existing systems.

The scope of work includes:

- Development and deployment of the software solution.

- Providing technical support and maintenance post-implementation.

- Conducting training sessions for end-users.

- Ensuring compliance with financial regulations and internal policies.

Eligibility Criteria

To participate in this tender, interested bidders must meet the following eligibility criteria:

- The bidder must be a registered entity with relevant experience in developing financial software solutions.

- A proven track record of successful implementations in similar environments is essential.

- Additional criteria may include financial stability and the ability to provide ongoing support and maintenance.

Technical Requirements

Proposals must include a detailed overview of technical specifications. This should encompass:

- System architecture and integration capabilities.

- Data security measures and compliance standards.

- User interface design and user experience considerations.

- Customizability and scalability of the software solution.

Financial Requirements

Bidders are expected to provide a comprehensive financial proposal that outlines the cost of the solution, including:

- License fees.

- Maintenance and support costs.

- Any other associated expenses. Financial stability documentation may be required to ensure the bidder can meet the proposed financial commitments.

Document Submission Details

All proposals must be submitted electronically through the designated online platform. Bidders should ensure that all required documentation is included with their submission, as incomplete submissions may be rejected. The specific formats for document submission will be detailed in the guidelines provided upon access to the tender.

Special Provisions

The tender aims to encourage participation from Micro, Small, and Medium Enterprises (MSEs) and startups. Preference may be given to solutions that comply with the 'Make in India' initiative, promoting local content in the solution design and implementation.

Evaluation Process

The evaluation of submitted proposals will utilize a comprehensive scoring system that considers:

- Technical merit.

- Financial feasibility.

- Compliance with the submission requirements.

- Value-added services.

Delivery Locations

Services will be required at various locations determined by the Department of Financial Services, primarily targeting financial institutions across the country. Proposals should detail the bidder's capability to deliver services nationally.

Contact Information

For additional information or queries regarding this tender, bidders are encouraged to refer to the official communication channels provided by the Department of Financial Services.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

9 DocumentsDocuments Required from Seller

- Experience Criteria

- Bidder Turnover

- Additional Doc 1 (Requested in ATC)

- Additional Doc 2 (Requested in ATC)

- Additional Doc 3 (Requested in ATC)

- Additional Doc 4 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Corrigendum Updates

Similar Tenders

Frequently Asked Questions

The eligibility requirements for participating in the custom bid for credit card management software solution include being a registered entity with relevant experience in financial software development. Bidders must demonstrate their track record in similar projects, ensuring that they can deliver a compliant and high-quality solution. Additional criteria may include the bidder’s financial stability and their capacity to provide post-implementation support.

Proposals for the credit card management software solution must include detailed technical specifications, such as system architecture, integration capabilities with existing financial systems, data security measures in line with regulatory requirements, and user interface design. Furthermore, the software must demonstrate customizability and scalability to cater to the evolving needs of financial institutions.

All interested bidders must submit their proposals electronically through the designated online platform specified in the tender documentation. It is crucial that submissions are complete, including all required documentation in the accepted formats, as incomplete submissions could be disqualified during the evaluation process.

Yes, the tender includes special provisions for Micro, Small, and Medium Enterprises (MSEs), encouraging their participation. Solutions that align with the ‘Make in India’ policies, which promote local content in software development, will also be favored in the evaluation process, providing additional support for startups and local businesses.

The payment terms for the services rendered under this tender will typically be outlined in the final contract following selection. Detailed pricing structures, including milestones for deliverables and ongoing support costs, will be subject to negotiation during the contracting phase. The evaluation committee will consider financial feasibility as a key component in the selection process.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders