Department of Financial Services Tenders (GEM/2025/B/6118938)

Custom Bid for Services - SELECTION OF VENDOR FOR CENTRAL BANK DIGITAL CURRENCY (CBDC) SOLUTION

Tender Timeline

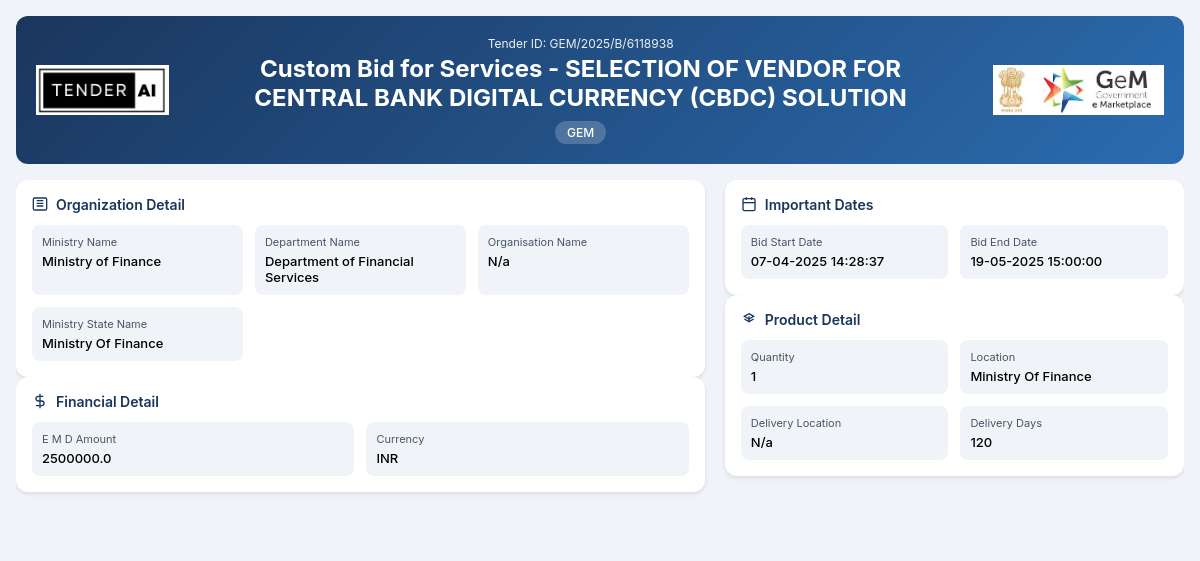

Tender Title: Selection of Vendor for Central Bank Digital Currency (CBDC) Solution

Reference Number: GEM/2025/B/6118938

Issuing Authority/Department: Department of Financial Services, Ministry of Finance

The Government of India is seeking a qualified vendor to provide a Central Bank Digital Currency (CBDC) Solution through this tender. The objective is to identify a capable vendor that can effectively develop, implement, and support an comprehensive CBDC platform which meets the regulatory frameworks and operational requirements established by the Reserve Bank of India (RBI). The selected vendor will play a key role in shaping digital currency initiatives aimed at enhancing financial inclusion and payment efficiency across the nation.

Scope of Work and Objectives

The scope includes designing and developing a robust CBDC framework that addresses the functionality, security, and interoperability with existing financial systems. Vendors will be required to provide end-to-end services, including system architecture, software development, deployment, and maintenance of the CBDC platform. The objectives include enabling secure and seamless transactions, ensuring compliance with existing financial regulations, and fostering innovation in digital financial services.

Eligibility Criteria

To participate in this tender, vendors must meet specific eligibility criteria. This includes being a registered entity recognized under applicable laws, holding necessary licenses and certifications, and having relevant experience in the fintech and digital payment solutions domain.

Technical Requirements

The technical requirements focus on the integration and functionality aspects of the CBDC platform. Vendors are expected to have capabilities in areas such as:

- Blockchain technology and digital ledger systems

- Data security and encryption standards

- User authentication and identity management systems

- Compliance with regulatory technical requirements established by the RBI

Financial Requirements

Potential vendors should outline their financial proposals, including a detailed breakdown of costs associated with the development and ongoing maintenance of the CBDC solution. The evaluation of financial submissions will be accompanied by a rigorous assessment of the vendor’s financial health.

Document Submission Details

All documentation related to the tender must be submitted electronically through the designated portal. Vendors should ensure that submissions include all required information such as proposal documents, technical specifications, company profiles, and financial bids.

Special Provisions

This tender does not specifically outline provisions for Micro, Small and Medium Enterprises (MSEs) or startups; however, participants may refer to applicable government policies regarding support for MSEs and startup initiatives.

Evaluation Process

The selection of the vendor will be based on a comprehensive evaluation process that considers the quality of the technical proposal, financial competitiveness, and vendor capabilities. This multidimensional approach ensures a thorough assessment aligned with governmental standards and objectives.

Delivery Locations

The CBDC solution must be scalable and adaptable for seamless integration across the different banking and financial institutions throughout India.

Contact Information

For further inquiries or clarifications regarding this tender, potential vendors should refer to the official contact channels provided within the tender portal.

This tender represents a pivotal opportunity for firms specializing in fintech solutions to contribute to the future of digital currency in India. The successful vendor will lead the way in fostering secure and efficient digital payments, ultimately contributing to enhanced economic stability and growth.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

8 DocumentsDocuments Required from Seller

- Experience Criteria

- Certificate (Requested in ATC)

- OEM Authorization Certificate

- Additional Doc 1 (Requested in ATC)

- Additional Doc 2 (Requested in ATC)

- Additional Doc 3 (Requested in ATC)

- Additional Doc 4 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity with the necessary licenses, possessing expertise in fintech solutions, having relevant prior projects or contracts experience, and demonstrating compliance with applicable laws and regulations.

Vendors must meet comprehensive technical specifications related to blockchain technology, data encryption, transaction security, and compliance with RBI regulatory frameworks. Additionally, the ability to manage user identities and authentication securely is crucial.

The financial requirements encompass detailed bids outlining development and maintenance costs for the CBDC solution. Vendors will need to prove their financial viability and capability to fulfill the project within budget constraints.

Proposals must be submitted electronically via the designated tender portal. It is crucial that bidders follow the specified submission methods and ensure their documents are in accepted formats for evaluation.

While specific provisions for Micro, Small, and Medium Enterprises (MSEs) in the CBDC tender are not explicitly stated, interested parties may look into governmental support frameworks that promote inclusivity and procurement from MSEs.

This tender holds a significant opportunity for vendors equipped to lead innovations in the digital currency spectrum.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders