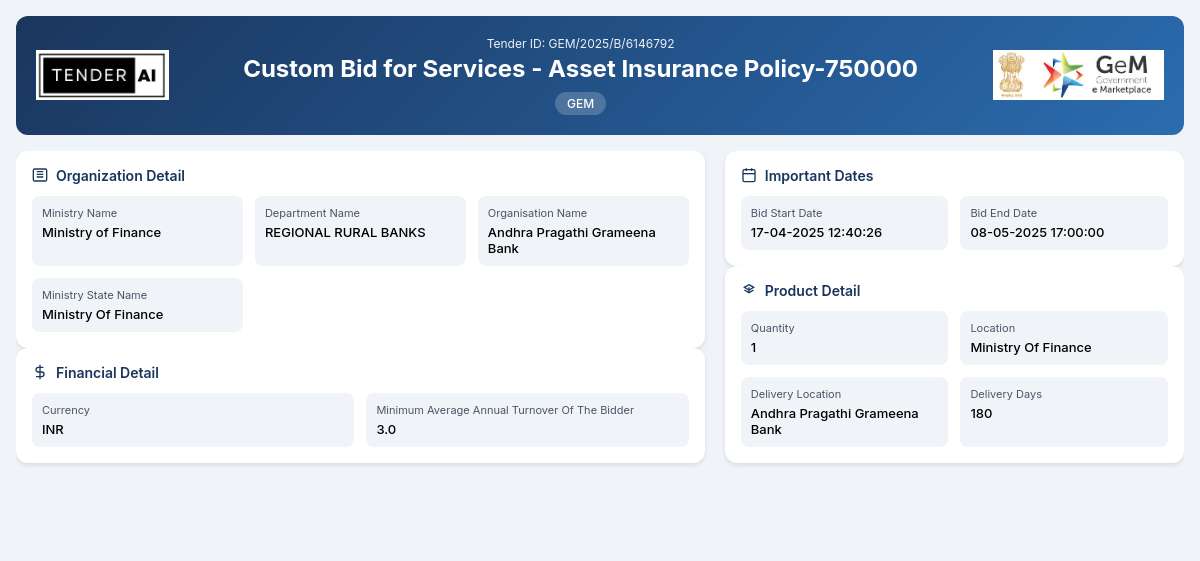

REGIONAL RURAL BANKS Tender by Andhra Pragathi Grameena Bank (GEM/2025/B/6146792)

Custom Bid for Services - Asset Insurance Policy-750000

Tender Timeline

Tender Title: Custom Bid for Services - Asset Insurance Policy

Reference Number: GEM/2025/B/6146792

Issuing Authority/Department

The tender is issued by the Regional Rural Banks, under the supervision of the Ministry of Finance.

Scope of Work and Objectives

The primary objective of this tender is to procure an Asset Insurance Policy designed to safeguard the assets of the Regional Rural Banks. This service aims to ensure financial protection against various risks associated with asset management, thereby fostering operational stability and resilience among the banks. The asset insurance policy will cater to specific needs, providing comprehensive coverage to ensure asset recovery and continuity of services.

Eligibility Criteria

Eligible participants for this tender should be registered entities with a proven track record in providing insurance services. Bidders must demonstrate previous experience in handling similar asset insurance services with government bodies or financial institutions.

Technical Requirements

The submitted proposals must meet specific technical specifications including:

- Proof of ability to provide adequate insurance coverage for various asset classes.

- Adherence to recognized quality standards for financial instruments.

- Compliance with all applicable local and national regulations regarding insurance.

Financial Requirements

Participants are expected to outline their pricing structure and include comprehensive financial documents proving their fiscal stability. The proposal should demonstrate competitiveness in pricing while ensuring quality coverage.

Document Submission Details

All required documents must be submitted electronically through the designated platform. Bidders should ensure that all documents are complete and conform to the specified formats.

Special Provisions

Micro, Small, and Medium Enterprises (MSEs) and startups are encouraged to participate in this tender. Special considerations will be provided to support the inclusion of these entities in the bidding process, aligning with the government's initiatives to promote entrepreneurship and local business support.

Evaluation Process

Proposals will be assessed based on a combination of technical and financial evaluations. Key considerations will include adherence to specifications, pricing competitiveness, and the bidder's experience and reliability. The evaluation committee will ensure transparency in the selection process.

Delivery Locations

Services are expected to be delivered across various Regional Rural Banks locations, ensuring nationwide coverage and support.

Contact Information

For further details and queries regarding this tender, participants should refer to the official channels provided by the issuance authority.

General Information

Financial Information

Evaluation and Technical Information

Tender Documents

7 DocumentsDocuments Required from Seller

- Experience Criteria

- Bidder Turnover

- Certificate (Requested in ATC)

- Additional Doc 2 (Requested in ATC)

- Additional Doc 3 (Requested in ATC) *In case any bidder is seeking exemption from Experience / Turnover Criteria

- the supporting documents to prove his eligibility for exemption must be uploaded for evaluation by the buyer

Similar Tenders

Frequently Asked Questions

The eligibility requirements include being a registered entity with experience in providing insurance services, especially covering asset management. Bidders must showcase their previous work with government bodies or recognized financial institutions, ensuring compliance with all relevant laws and regulations governing insurance.

For the tender, it is crucial to provide an insurance policy that meets specific technical specifications, including comprehensive asset coverage, adherence to quality standards recognized in the industry, and compliance with local and national regulations. Bidders should also include evidence of the financial instrument’s reliability and performance metrics.

Documentation for submission must be completed electronically using the designated tender platform. Accepted document formats generally include PDF for proposals, with clear labeling and organization to facilitate the evaluation process. Bidders should ensure that all documents are clear and complete to avoid disqualification.

Bidders may be required to provide a performance security deposit as part of the conditions for the contract. This serves as a financial assurance for fulfilling the contract terms. Payment terms will typically be outlined in the tender documents, detailing how and when payments will be remitted following the fulfillment of agreed-upon milestones.

MSEs have special provisions in this tender, designed to encourage participation and equitable competition. These benefits may include relaxed eligibility criteria, preferential scoring in evaluation processes, and support under government initiatives aiming to empower small enterprises and local businesses, aligning with the ‘Make in India’ campaign and local procurement rules.

Probable Bidders

Get Tender Alerts

Get notifications for similar tenders